I loved Howard. And I was mad at it too. Both can be true. Let me explain.

Quick backstory

I came to Howard wide-eyed, first-gen, and stubborn. I had a small Pell Grant, a work-study job in Founders Library, and a mix of subsidized and unsubsidized loans. My mom took a small Parent PLUS loan my sophomore year. We thought we planned well. We really did. And I now know I wasn’t alone—Howard itself has acknowledged that more than 70% of its students demonstrate high financial need and that over 40% are Pell-eligible (source).

But the bill did its own thing.

If you want a semester-by-semester snapshot of exactly how those charges ballooned, you can read the full breakdown in this deep-dive on my growing Howard bill.

Where the debt jumped

-

Housing and meals: My freshman year dorm and meal plan felt steep but doable. By junior year, on-campus housing wasn’t guaranteed for me, so I moved off campus near LeDroit Park with two roommates. Rent and a WMATA pass ate my budget. Books and groceries finished it off. Loans filled the gap.

-

Fees that sneak up: My account on BisonWeb added a “technology fee” and a “lab fee” one spring. Together, it was about $225. Not huge alone, but that was two weeks of groceries. I missed the first due date, got a $100 late fee, and boom—more debt.

-

Aid that shifted: I lost a small departmental scholarship because I dropped a credit and fell below full-time for a semester. I didn’t even know that rule. My aid package changed mid-year, and I had to take an extra $1,000 unsubsidized loan to clear a hold.

-

Interest doing its quiet thing: The unsubsidized part started building interest while I was in class. When I put loans in forbearance for three months after graduation—just to breathe—interest capitalized. That word sounds boring. It’s not. It hurt.

Real numbers from my account

I’ll keep it simple and real.

- Freshman year loans: $5,500 subsidized, $2,000 unsubsidized

- Sophomore year: another $7,500 (split), plus $1,500 Parent PLUS

- Junior year: $8,500 in my name, $1,000 unsubsidized to cover a shortfall

- Senior year: $8,500, plus I used a $3,000 private scholarship from UNCF and a $1,000 outside award from my church to avoid a bigger PLUS loan

When I walked at graduation, my total was around $31,000. After the forbearance and capitalized interest, my balance showed $34,2xx with Aidvantage as my servicer. That jump made me sit very still for a minute.

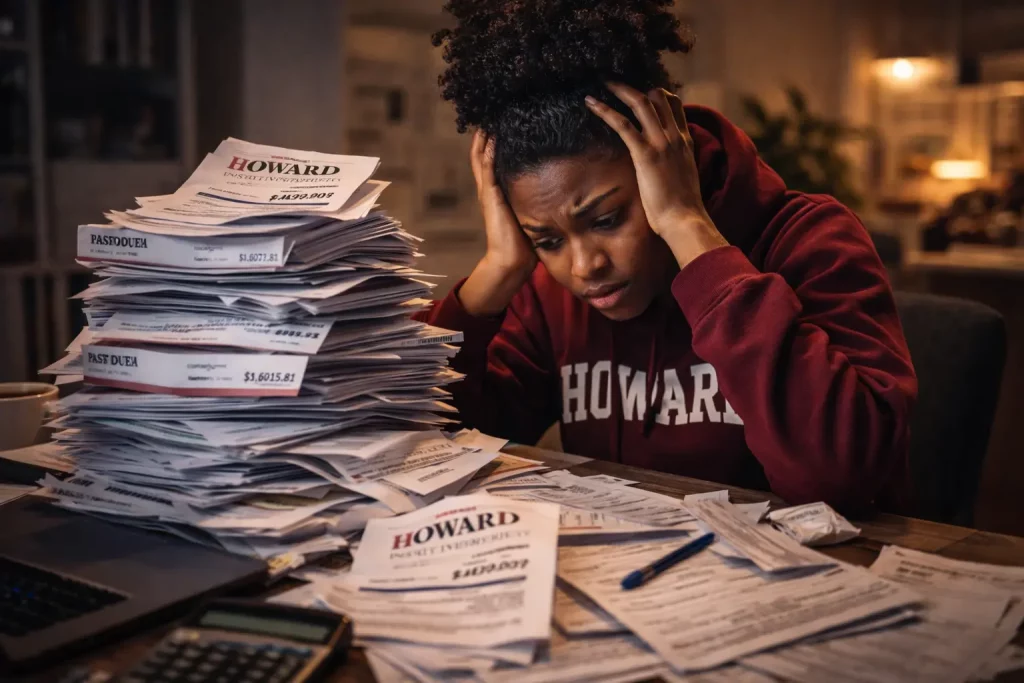

The portal, the holds, the panic

BisonWeb showed a red “past due” notice once when I was short by $213.47. That tiny number blocked my fall registration. I stood in line at the Office of the Bursar on a humid August morning, sweating through a jean jacket, calling my aunt to borrow $200. I paid it, the hold lifted in an hour, and I grabbed the last open seat in a required class. That one day? It decided my whole schedule.

You know what? I still feel that knot in my stomach when I remember the “account hold” message.

What helped (and what didn’t)

Helped:

- Work-study: Twenty hours a week at the library didn’t make me rich, but it kept me from swiping the card for takeout.

- Payment plan: I set up a monthly plan through the bursar. There was a setup fee (about $45), but it stopped late fees and kept me enrolled.

- Office hours with financial aid: When I brought a printed bill and asked clear questions, things moved faster. One counselor helped me file a satisfactory academic progress appeal after I slipped a credit. That saved a grant.

- Scholarships I almost missed: UNCF had a rolling award I applied for on a Sunday at 11 p.m. I got $3,000. It cut a loan. Worth every sleepy minute.

Didn’t help:

- Late textbook buys: I tried to wait for used books. Sometimes the professor used a brand-new code. I paid full price anyway, plus rush shipping. Painful.

- Forbearance after graduation: It felt like relief. It cost me later. My interest took a victory lap and added itself to the balance.

How it felt, for real

I was proud to be at Howard. I was also tired of doing math in the grocery aisle. The culture, the yard, the professors who saw me—it was worth so much. But the money part can make you feel small. I hated that. Some days I was bold. Some days I cried in the shower and then went to class like nothing happened. If you ever find yourself wondering how much is too much student debt, you can check out my honest take on setting that boundary.

Would I still choose Howard?

Yes. And I’d do some parts smarter. I’d push sooner. I’d ask for help sooner. I’d cut debt faster by $20 and $50 at a time. It sounds small. It adds up.

Tips I wish I heard sooner

- Treat unsubsidized interest like a pesky subscription: Pay $10–$25 a month while in school. It keeps interest from stacking.

- Read the fine print on credits: Dropping to 11 credits can change aid. Ask financial aid before you drop a class, not after.

- Use campus money folks by name: The Office of Financial Aid and the Bursar aren’t scary if you come with dates, amounts, and a short list of questions—their site lays out payment plans and contact info (Office of Financial Aid resources).

- Stagger book costs: Ask classmates if an old edition works. Many did. Swapping in the group chat saved me $80 more than once.

- Local life hacks: The Giant near Shaw had store-brand deals that beat delivery apps by a mile. Walk when you can. WMATA pass beats random rideshares.

When the stress of budgets and classes piled up, I looked for low-cost ways to decompress and actually meet people off campus. One unexpected outlet was browsing meetup-style dating sites—quick conversations, zero cover charge, and a reminder that life is bigger than my BisonWeb balance. If you ever need that kind of no-strings, lighthearted break, check out FuckLocal for a fast way to connect with other nearby adults; a quick coffee or study break with someone new can reset your brain without wrecking your wallet. For a slightly more structured, face-to-face option, I once tried a discounted student night of rapid-fire introductions in the Atlantic nightlife corridor—the calendar at One Night Affair’s Atlantic speed-dating page lays out upcoming events, ticket prices, and RSVP details so you can snag a fun social reset without sabotaging your budget.

- Call your servicer early: Mine was Aidvantage. I asked about the SAVE plan and got a payment I could handle my first year out. It wasn’t perfect, but it stopped the spiral.

A tiny win that kept me going

Senior spring, I landed a $500 departmental award for a project. I paid it straight to the account. That $500 didn’t fix everything. But it cut my balance, killed a late fee, and gave me air. Sometimes a small win is the bridge. Need a broader view of your options? Resources like Occupy Student Debt break down repayment strategies and policy updates in plain language.

Final take

Howard grew me. My debt grew too. Both stories live side by side. If your bill is creeping up, you’re not failing. You’re managing a system that’s messy and fast. Keep your papers. Ask questions that feel “too simple.” Pay the little bits when you can. Celebrate the $50 wins.

And if you’re standing in that bursar line with a knot in your chest—I’ve been there. You’ll get through.