ourtimeorg:

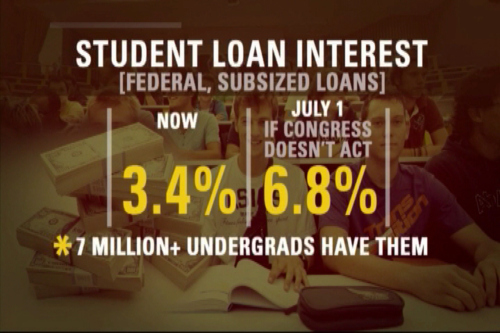

If Congress does not act, interest rates on student loans will rise from 3.4% to 6.8% on July 1 for an estimated 7.4 million U.S. undergraduates who have federal loans. LIKE this if you want to see rates kept at 3.4%, and SHARE it if you believe our states and federal government need to prioritize making education more affordable!

More translations at www.ourtime.org

Can’t afford to do anything but pay my loans. Lives with parents. My job was supposed to make me $80K a year..it pays $35K. I’d rather flip hamburgers debt-free and just hookup than be in this mess.

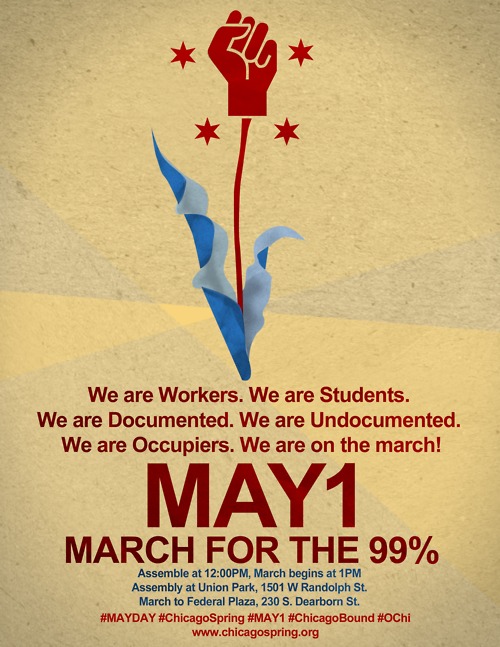

Are YOU ready? Better be…We’ve partnered with Occupy Colleges, Backbone Campaign, Rebuild the Dream, Occupy Together, OWSpr, Project on Student Debt, DEFAULT: The Student Loan Documentary, and ForgiveStudentLoanDebt.com and others to bring everyone Occupy Graduation!

Musician with horrendous Student Loan

I am a full time musician who graduated in 1996 with an original student loan dept of $80,000 that since then has escalated to over $105,000. As you know, musicians do not make a lot of money as it is, but I never fully realized I would have to carry such a burden now, especially at the age of 45.

Anyone else blame their college financial aid office??

Mr. Samuel Pratt

I recently finished a degree program with initial goal for a PHD degree but settled for a second Master’s degree. I am up to my throat buried in student loan debt. I owe approximately 180K in Student Loan debt. I cannot come up with a job, even in the most minimal technical jobs. Yesterday, like most days, I got two rejection letters, nicely written, that though I am qualified, they have hired another candidate most suitable for the position. At this rate, I am never, ever going to be able to pay back every penny of these loans. Except, may be if GOD willing, HE blesses me with financial wealth, as I preached in my congregation and promised before them and GOD, that I will pay back every single penny of my student loans. Then and only then, will I be able to repay back every dime. GOD Help us.

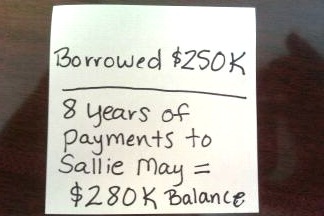

Sallie Mae

What to do? Sallie Mae is taking me to “legal” now. They have cashed my little checks each month, but won’t put it towards the $150 that it costs to defer the loan. They can only accept one check to do that whether I have paid $150 already, but it was several payments and not on one check. Who else does this? Will my loans be forgiven if this law passes and I’m already in “legal” which I guess means I’ll be with another bill collector?

Middleclass American

- I owed $52,000.00 (alot of interest)after garnishment I now owe $26,000.00 that has gone to a collection agency (NCO). I am now paying $256 monthly and I can’t buy a home (or rent a home in a good neighborhood) purchase a good vehicle because AES is still on my credit report ( i am being turned down when I apply for anything). Thank GOD I live 4 blocks from my job because I am a middleclass American walking to work!