I graduated from a small private school in California. I have a BS in Anthropology and Environmental Studies. I got an excellent education. My parents could not afford to pay for college, and my school did not give out good financial aid, so I took out loans. I originally took out around 90k. I have 5 student loans, 4 of which are private.

When I first graduated college I moved to Portland, Oregon and worked a job which paid $9.00 dollars an hour because it was all that I could get (the job market up there is very bad). I had 6 months before the 4 out of 5 of loans started kicking in. I had my first mental breakdown in January of 2010 when my first payments were due, and they started around $500.00. I had no idea that it was going to be this much. I found another part time job, this one making $11.90 an hour. I worked six days a week and had to commute 35 miles for my jobs. I had to borrow money from my parents, grandparents, and roommates to get by, although it wasn’t really borrowing since I couldn’t afford to pay them back. I had to call two loan companies to change my payment plan so that I pay less now, and more later (meaning $150.00 now, and will eventually have payments of $450.00, and this is just for one loan!). By June of 2010, my 5th loan started kicking in, making my monthly totals $668.78. As my first part time job was as a teacher and ended right before summer break, I was back to one part time job. I then applied for food stamps, because all of my income was going towards student loans. I fed myself for the next few months on food stamps (thank god for that!).

Since my second part time job was technically a paid internship, I discovered that some loan companies allow you to defer during your employment. I was able to defer two private loans until the end date of my internship (August of 2010). My federal loan (Direct Loan) allowed me to defer for up to a year. The two other private loans wouldn’t help me. Once my internship was over I contacted my loan companies to let them know that I was now unemployed and was looking for work and may not be able to make full payments. They all were pretty helpful, or at least kind, except for Wells Fargo. Wells Fargo told me that even if I had $50.00 dollars left to my name, it should go to them. I made partial payments for about 3 months, thinking that as long as I paid something ($50.00 or $75.00 out of $150.00) that they would get off my case as I have called them many times to explain my situation and I could catch up once I had a job. They started harassing my co-signers (parents) and calling them every morning at 8am making threats. My parents aren’t in a good financial situation (also a lot of debt) and I woke up every morning feeling stressed and sick thinking that Wells Fargo would take action (over me being only $150.00 behind).

I moved back to California to live in my parent’s basement, since all the money that I was making was going straight to these companies and I couldn’t afford rent. I am so thankful that I have family that can help me in a time of need by providing shelter and assistance. If I didn’t have them, I don’t know what I would do. I have been pretty lucky in that I haven’t had much trouble finding work. After about 2 months (which I consider good) I found a job that pays over $19.00 an hour. However, with a monthly loan payment of $668.00 a month, I cannot afford to be independent and still can’t afford to live on my own. After taxes, 28% of my income goes to student loans alone. That is almost 1/3. I have been living in my parent’s basement for a year now, with no savings to show. I am 25 years old. I don’t know when or if I will be able to afford living on my own, especially in this economy.

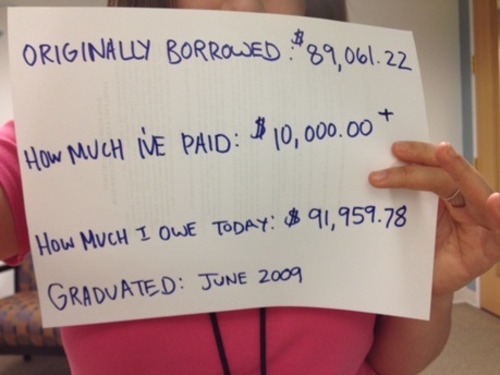

I really had no idea what I was getting into, as loan payments did not become a reality until after college. I never experienced anxiety until the loan payments started, and I have been stressed ever since. At this rate, paying the minimum, I will pay off my loans in about 30 years (when I am 55). Having a large debt of 90k (not including interest) at 22 years old is scary and its even more than that today with interest applied. Although my borrowed amount was $89,061.22, since graduation (2.5 years) I have paid off over $10,000.00, and I still owe more than I borrowed with a current balance of $91,959.78. I have been busting my butt and have not even taken a dent in the money that I originally borrowed. I am not planning on ever buying a house, or a car, or having the “American Dream”. But hey, at least I am surviving and am healthy, right? I don’t think I would be where I am today without my college education, as I am in the field that I want to be, and really enjoy my job, but I definitely question my decisions. I always come back to telling myself “you can’t do anything about it now, so just deal with it”. I am trying to deal with it as best as I can.