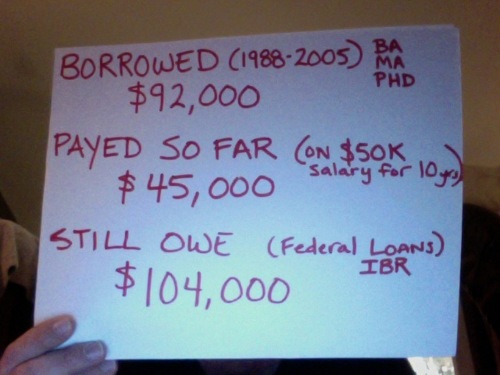

I went to three in-state colleges and worked multiple jobs to pay for my three degrees (BA, MA and PhD) because my family could not afford to send me to college. I was fortunate and got a job as an assistant professor at a prestigious state college immediately upon graduation in 2005. My starting salary was $41,000 (now $52,000). I “did everything right” according to all of my undergraduate and graduate advisors. I consolidated my loans with the Direct Loan/IBR program and have payed $500/mo since 2001, even while I was in school. I have never missed a payment in ten years, at times working 3-4 jobs to keep up with payments (on top of school). Because my salary is so low and state payrolls are being cut, my payments are low and have never been enough to cover the accrued interest each month (my rate is 6%). After ten years of payments, plus accrued interest, my principal is now $104,000 - over 10,000 more than I borrowed, despite nearly 45,000 in payments.

I am enrolled in the IBR program which has lowered my payments so that I can meet my loan payments and living expenses. I am in my 40s, gainfully employed while serving my community, and I am scraping by. I can not buy a house, I drive a ten year old car with 150,000 miles, and still have to decide whether I can afford to go to a movie from time to time.