Tag Results

626 posts tagged submission

626 posts tagged submission

I am a full time musician who graduated in 1996 with an original student loan dept of $80,000 that since then has escalated to over $105,000. As you know, musicians do not make a lot of money as it is, but I never fully realized I would have to carry such a burden now, especially at the age of 45.

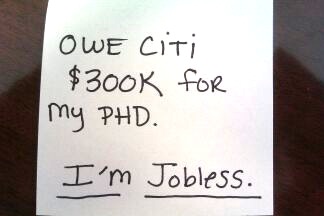

I recently finished a degree program with initial goal for a PHD degree but settled for a second Master’s degree. I am up to my throat buried in student loan debt. I owe approximately 180K in Student Loan debt. I cannot come up with a job, even in the most minimal technical jobs. Yesterday, like most days, I got two rejection letters, nicely written, that though I am qualified, they have hired another candidate most suitable for the position. At this rate, I am never, ever going to be able to pay back every penny of these loans. Except, may be if GOD willing, HE blesses me with financial wealth, as I preached in my congregation and promised before them and GOD, that I will pay back every single penny of my student loans. Then and only then, will I be able to repay back every dime. GOD Help us.

What to do? Sallie Mae is taking me to “legal” now. They have cashed my little checks each month, but won’t put it towards the $150 that it costs to defer the loan. They can only accept one check to do that whether I have paid $150 already, but it was several payments and not on one check. Who else does this? Will my loans be forgiven if this law passes and I’m already in “legal” which I guess means I’ll be with another bill collector?

How can I pay this if I can’t find a job and can’t afford to move to get one outside of my city? I should have just disappointed generations before me and not gone to college.

I have been reading the argument on how people sign the contract and should be liable for their debt they are incurring from their student loans. How many actually read the document and how many were encouraged by television ads and other media or even friends and counselors at school that getting a higher education is the way to go. I realize now that higher education was a wonderful thing, however not worth the cost of it. Education in this country should be free, then we would not care as much how terrible our politicians are today and how worthless our government is as a whole. People need to stand up for what they believe and wake up to what is happening.

Outstanding Balance: $7,904.52 View Payoff Details Scheduled Payment $200.00 on 3/14/2012 Monthly Auto-Debit 108.67 on 9/28/2015 Last Payment:

$2,400.00 on 2/2/2024

Status:

Multiple

Benefits/Details View Loan Benefits and Details

I am paying and paying and paying, came from Poland, study English and Economics in Central Connecticut State University and I am not a deadbeat. I took $14,000 for my Bachelor degree and I have 3 more semesters until I graduate. I will graduate without taking more loans, as I found a way to get grants and scholarships until graduation. Anyway, I borrowed $14K, paid $6,100 so far and still owe $7,900! Why is college so expensive? I pay $200 each week but the balance is moving so slow. Is there any option to get the hell out of the balance?

Last Payment:

I tried to set up payment plans on my student loans, but they wanted astronomical down payments that I didn’t have. I let my loans default until they required wage garnishments. They take 15% of my salary. For a while I had two separate garnishments, one to Wells Fargo and another to Texas Guaranteed. Wells Fargo is now paid off. Now $622 comes out of my check monthly. I still owe over $13k. They also take my income tax refund each year.

I graduated from a local private college last May. I went back to school with elementary kids at home. I could not qualify for financial aid because my husband Makes $90,000.00 a year. Yes, that is a decent salary, but raising a family with so many fixed expenses in this economy is an obstacle. My tutition for this private college was $8,000.00 a semester. I also took out a little extra to make ends meet for gas, teaching expenses, etc. Fast forward one year I am now 43 years old with no teaching job. I have been subbing in the county for the past year, and there are 80 applicants for elementary education jobs in Grady County. If I do not receive a job soon, I will be forced to take any job because I can not keep Wells Fargo from hounding me everyday, three times a day. My payment is $679.00 per month. I also have a few more loans out, but that is my biggest and hardest to manage. The other loans range from $50.00 (which I have been paying) to 150.00 per month. So far I have paid $900.00 so far to Wells Fargo. I need to be worrying about retirement and putting my exceptionally gifted kids through college, but I am burdening my family with this debt. I am a Christain, but lately I have felt like killing myself over this!

Current balance, $175,000. Original Principle was $120,000. Administered by Sallie Mae and National Collegiate Trust (American Education Services) I imagine in the next few years it will be a quarter million.

I’ve never been able to touch the principle since i started paying. I struggled finding a job for 2 years after school, and my interest skyrocketed during forbearance and deferment.

Now i finally have a well paying job as a graphic designer, and i still struggle. My job is very demanding, i work long hours, and usually have to take side work to make due. I mostly live paycheck to paycheck, my monthly payments equal around another month’s rent, about $1200. I also suffered two great family losses in one year, had to move, and had some health problems. Which put a huge financial burden on my life. Sallie Mae and National Collegiate Trust have no sympathy or understanding for their customers. At this point i’m so far behind payments, I have no idea how i’m going to catch up. I get about eight phone calls a day harassing me for money i don’t have, threatening to sue me, and unwilling to work around my pay schedule or income. It’s humiliating, demoralizing, and disruptive. This disturbance and added stress makes it difficult to concentrate on my work, and takes a toll on my general well being. I’ve even had the collections agencies (who are owned by the lenders) make harassing phone calls to my office, extended family, and even friends.

At 19, had i known my education was going to cost me over a quarter million dollars, i would have made other arrangements. But the schools are payed by these lenders to sell you these loans, and they sell that dream of success really well. My only hope now is that my family and I remain in good health and hopefully the laws change soon.

…but we’re not rich, by any means.

I completed a BA and later an MA in English, and my loans totaled $42,000 when I graduated with my MA in 2008.

Undergrad loans: $28,000 original balance when consolidated (at 6.0% fixed) to a graduated repayment program in 2001. I knew when I signed the paperwork that I would eventually pay more than TWICE what I borrowed over the course of the 25 year repayment terms. I am okay with that, because I know that English doesn’t pay well, and if I managed to ever make a decent wage, I could always pay more than the minimum payment, but at least I could afford the minimum payment, which will never go above $285/mo. Current balance is still over $26,000.

Graduate loans: approximately $14,000 originally. My husband worked for the inexpensive, non-elite, middle-of-the-road, state school at which I got my MA. Instead of paying the full semester grad tuition of nearly $2300, I paid about $650, thanks to employee benefits. My husband worked full-time and I worked nearly full-time during my grad school years. I often taught three classes as an adjunct at a community college in a different state 35 miles away and took three classes at my university. I have three separate loans from grad school:

Subsidized loan (6.55%)—original balance: $6500 in 2008; current balance: $5163

Unsub loan (6.55%)—original balance: $5500 in 2008; current balance: $4942

Perkins Loan (5.0%)—original balance: $1990 in 2008; current balance: $764

My husband and I bought a house six months after I got my MA, and WE HAD NEARLY $60K COMBINED in student loans.

I am an adjunct English instructor who makes maybe $30K a year in a good year. Some quarters I bring home more than my husband.

How have we managed to pay down the balance of our loans?

We have only one car. My husband takes public transportation to work (his employers subsidizes 90% of his bus pass), while I drive between colleges to teach.

We bought a house that was priced $100K below the amount for which we were approved in 2008.

We don’t buy anything unless we can pay cash for it. That means we don’t have a big TV or a nice sound system. Our one car is seven (maybe eight?) years old. As much as I want the new iPhone 4S, I refuse to pay $200 for the upgrade because I don’t have the money, so I still have a broke-down, slow-ass iPhone 3 (it’s not even the 3G). As much as my husband wants the new xBox Kinect, we don’t have the money, so he makes do with the xBox we bought with our wedding money when we were married SIX YEARS AGO. We don’t travel—we moved across the country from our friends and family five years ago, and we haven’t been back. We’ve missed weddings and graduations and births and deaths and all kinds of big things, but we have a budget and we stick to it, as much as it sucks.

Most of our furniture is hand-me-down, including our two chests of drawers, dining room table, beds, and bed frames. We bought a couch and love seat when we first moved into our house, and it was $125 at a yard sale. It’s stained and has marker spots on it and the cushions are tearing at the seams, but we got $75 covers for them, and they look good as new.

The money we do have goes to pay off debt—student loans, the occasional credit card debt (since emergencies do happen and we’re still paying for them). And we save for the summers when I’m not teaching.

The point is, it’s not easy, and we’ve kept on top of it and avoided forebearances and deferments before things got out of control. I know it’s getting harder and harder to outright pay for an education, but it can be done with careful planning and research, and lots of hard work. I am looking at going back to get a PhD or a second Master’s, but if I do it, it will be at my own pace and I will pay cash as I go.