Tag Results

132 posts tagged Albert lord

132 posts tagged Albert lord

Are YOU ready? Better be…We’ve partnered with Occupy Colleges, Backbone Campaign, Rebuild the Dream, Occupy Together, OWSpr, Project on Student Debt, DEFAULT: The Student Loan Documentary, and ForgiveStudentLoanDebt.com and others to bring everyone Occupy Graduation!

I am a full time musician who graduated in 1996 with an original student loan dept of $80,000 that since then has escalated to over $105,000. As you know, musicians do not make a lot of money as it is, but I never fully realized I would have to carry such a burden now, especially at the age of 45.

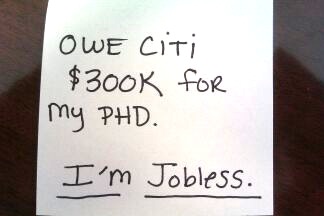

I recently finished a degree program with initial goal for a PHD degree but settled for a second Master’s degree. I am up to my throat buried in student loan debt. I owe approximately 180K in Student Loan debt. I cannot come up with a job, even in the most minimal technical jobs. Yesterday, like most days, I got two rejection letters, nicely written, that though I am qualified, they have hired another candidate most suitable for the position. At this rate, I am never, ever going to be able to pay back every penny of these loans. Except, may be if GOD willing, HE blesses me with financial wealth, as I preached in my congregation and promised before them and GOD, that I will pay back every single penny of my student loans. Then and only then, will I be able to repay back every dime. GOD Help us.

What to do? Sallie Mae is taking me to “legal” now. They have cashed my little checks each month, but won’t put it towards the $150 that it costs to defer the loan. They can only accept one check to do that whether I have paid $150 already, but it was several payments and not on one check. Who else does this? Will my loans be forgiven if this law passes and I’m already in “legal” which I guess means I’ll be with another bill collector?

How can I pay this if I can’t find a job and can’t afford to move to get one outside of my city? I should have just disappointed generations before me and not gone to college.

Years ago I went to college to study accounting, and like millions of other Americans I took out loans to pay for it. A few years later I got a temporary job in the accounting department at Bain & Co., and after 6 months of reliable work I was thrilled to be offered a full-time position.

However, just a few weeks after starting in my new position the company fired me because my debt-to-credit ratio was too high. I later learned that 60% of employers now check credit reports, which typically include student debts. How are you supposed to pay off your student debts if you can’t get (or keep) a job BECAUSE of your debts? And what do my student debts have to do with my ability to do a job well anyway?

25 states have debated bills in the last year to restrict this practice, and in a number of these states one company has fought hardest against these efforts: credit reporting company TransUnion.

What’s ironic is that Penny Pritzker, TransUnion’s Chair and part owner, sits on President Obama’s Jobs and Competitiveness Council, which advises the President on putting Americans back to work. How can someone advise on national job creation when her company sells products that may keep qualified people out of work?

Please join me and 25 national civil rights organizations in calling on TransUnion to stop its sale of credit reports to employers. As the only one of the “Big 3” credit reporting companies that’s privately held, TransUnion has the ability to stop this practice overnight.

It was recently announced that in the coming weeks TransUnion will be sold to two private equity companies, including Goldman Sachs. If Penny Pritzker is serious about job creation, she should do what she can to ensure that her company stops this abusive practice before the company is sold.

Click HERE to sign Latoya’s Change.org petition

Pls RT: what does my student debt have to do w/ my ability to do my job?

#StopTransUnion #OccupyStudentDebt #UniteHere

http://www.change.org/petitions/transunion-stop-selling-credit-reports-to-employers

I tried to set up payment plans on my student loans, but they wanted astronomical down payments that I didn’t have. I let my loans default until they required wage garnishments. They take 15% of my salary. For a while I had two separate garnishments, one to Wells Fargo and another to Texas Guaranteed. Wells Fargo is now paid off. Now $622 comes out of my check monthly. I still owe over $13k. They also take my income tax refund each year.

Current balance, $175,000. Original Principle was $120,000. Administered by Sallie Mae and National Collegiate Trust (American Education Services) I imagine in the next few years it will be a quarter million.

I’ve never been able to touch the principle since i started paying. I struggled finding a job for 2 years after school, and my interest skyrocketed during forbearance and deferment.

Now i finally have a well paying job as a graphic designer, and i still struggle. My job is very demanding, i work long hours, and usually have to take side work to make due. I mostly live paycheck to paycheck, my monthly payments equal around another month’s rent, about $1200. I also suffered two great family losses in one year, had to move, and had some health problems. Which put a huge financial burden on my life. Sallie Mae and National Collegiate Trust have no sympathy or understanding for their customers. At this point i’m so far behind payments, I have no idea how i’m going to catch up. I get about eight phone calls a day harassing me for money i don’t have, threatening to sue me, and unwilling to work around my pay schedule or income. It’s humiliating, demoralizing, and disruptive. This disturbance and added stress makes it difficult to concentrate on my work, and takes a toll on my general well being. I’ve even had the collections agencies (who are owned by the lenders) make harassing phone calls to my office, extended family, and even friends.

At 19, had i known my education was going to cost me over a quarter million dollars, i would have made other arrangements. But the schools are payed by these lenders to sell you these loans, and they sell that dream of success really well. My only hope now is that my family and I remain in good health and hopefully the laws change soon.

This week we worked with The Backbone Campaign for the Student Debt Jubilee action in Washington, DC.