Tag Results

230 posts tagged student loan bubble

230 posts tagged student loan bubble

I recently finished a degree program with initial goal for a PHD degree but settled for a second Master’s degree. I am up to my throat buried in student loan debt. I owe approximately 180K in Student Loan debt. I cannot come up with a job, even in the most minimal technical jobs. Yesterday, like most days, I got two rejection letters, nicely written, that though I am qualified, they have hired another candidate most suitable for the position. At this rate, I am never, ever going to be able to pay back every penny of these loans. Except, may be if GOD willing, HE blesses me with financial wealth, as I preached in my congregation and promised before them and GOD, that I will pay back every single penny of my student loans. Then and only then, will I be able to repay back every dime. GOD Help us.

Current balance, $175,000. Original Principle was $120,000. Administered by Sallie Mae and National Collegiate Trust (American Education Services) I imagine in the next few years it will be a quarter million.

I’ve never been able to touch the principle since i started paying. I struggled finding a job for 2 years after school, and my interest skyrocketed during forbearance and deferment.

Now i finally have a well paying job as a graphic designer, and i still struggle. My job is very demanding, i work long hours, and usually have to take side work to make due. I mostly live paycheck to paycheck, my monthly payments equal around another month’s rent, about $1200. I also suffered two great family losses in one year, had to move, and had some health problems. Which put a huge financial burden on my life. Sallie Mae and National Collegiate Trust have no sympathy or understanding for their customers. At this point i’m so far behind payments, I have no idea how i’m going to catch up. I get about eight phone calls a day harassing me for money i don’t have, threatening to sue me, and unwilling to work around my pay schedule or income. It’s humiliating, demoralizing, and disruptive. This disturbance and added stress makes it difficult to concentrate on my work, and takes a toll on my general well being. I’ve even had the collections agencies (who are owned by the lenders) make harassing phone calls to my office, extended family, and even friends.

At 19, had i known my education was going to cost me over a quarter million dollars, i would have made other arrangements. But the schools are payed by these lenders to sell you these loans, and they sell that dream of success really well. My only hope now is that my family and I remain in good health and hopefully the laws change soon.

$80,000 of student debt. How about you?

In 2010 something unthinkable happened – student debt surpassed credit card debt as the largest form of debt in this country, passing $800 billion dollars. In 2012 more history will be made as the amount of unpaid student debt climbs to $1 trillion dollars, with an additional $1 million dollars added to that number every 6 minutes.

The ripple effect that this has on our economy is crushing: students and recent graduates are forced into low-wage jobs in order to immediately start making payments back to banks and lenders; instead of stimulating the economy by spending millions of dollars, students and graduates are pinching pennies to just try to keep up with the interest on their loans; and the privatization of colleges and universities are expedited as the same loan agencies use the profit off of students to lobby for lower tax rates, forcing budget cuts to higher education in an economy where recent graduates struggle to find jobs.

Imagine students not working two part-time minimum wage jobs as they struggle to get through school, allowing them more time to participate in civic engagement. Imagine recent graduates not being pushed into a job market where they are forced to intentionally keep wages stagnant, allowing them the ability to work for non-profits or local businesses.

If we do not solve the student debt crisis the students of today will suffer, but the students of tomorrow may never have the opportunity to a college education. A generation of students will pay the hefty price of their student loans; but we must not forget that we will also pay the debt of an entire country ignoring the burden placed on those working to better their lives and communities by obtaining a college degree.

By Denise Smith, Kasey Oliver, and Ryan Jacobi in ForgiveStudentLoanDocumentary.com

H.R.4170 Campaign - What every member should do to get involved in the H.R.4170 Campaign!

Pease register at the www.forgivestudentloandebt.com Website! Stay up to date on all the latest FSLD news and share your story and participate in the forums!

#1 Petitions!!!

Sign the following petitions created by Robert Applebaum, Esq., founder of forgivestudentloandebt.com, asking Rep. John Kline (MN), The United States House of Representatives, The United States Senate, and President Barack Obama to Support the Student Loan Forgiveness Act of 2012 (H.R.4170):

Please also sign the following petitions in support of H.R.4170 created by members of the student loan community:

#2

Weigh in at PopVox by clicking on “support” and send a message to your representative. (There is a character limit of around 1500 for your comments)

https://www.popvox.com/bills/us/112/hr4170

#3

Go to OpenCongress and click the green “support” check mark, upper right side of page and send a message to your Representative and Senators—you also can print a copy for mailing.

http://www.opencongress.org/bill/112-h4170/show

#4

Mail a letter to your Representative strongly urging them to co-sponsor and support this bill! Tell them why you support H.R.4170, what its passage would mean to you personally and how it would benefit the economy!

Find contact Information: http://www.contactingthecongress.org/

#5

Call your Representative and strongly urge them to co-sponsor and support this bill!

Tell them why you support H.R.4170, what its passage would mean to you personally and how it would benefit the economy!

Find Your Representatives/Senators at http://www.contactingthecongress.org/

#6 If there is are open seats in your state, contact the candidates to ask them what their position is and encourage them to support H.R.4170.

Look here to locate them: http://www.politics1.com/states.htm

#7

Email your friends, family members and everyone you know!

Send them this petition link:

Ask them to sign. Tell them your story and explain how H.R.4170 will benefit not only borrowers but also our economy!

#8

If you are on twitter, tweet the following message to your followers:

#9

If you are on Facebook, copy & post the following message on your wall:

#10

If you are on other social networking sites please reach out there as well. The more we reach out, the more likely we are to hit our goal of 1 million signatures!

#11 Ready to take a really BIG step? Write to every last Representative in Congress. Set a daily goal and work down this list:

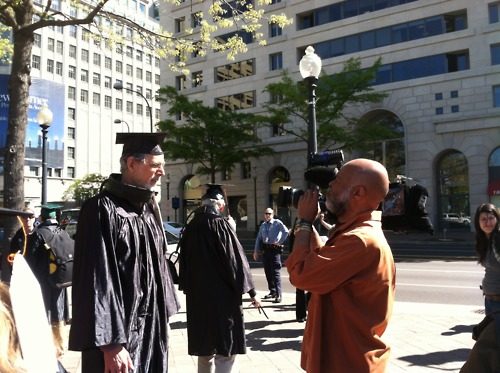

CEO of Sallie Mae refuses to meet with students, has them arrested for protesting usury :(

Baby Boomers saddled with debt! The Backbone Campaign organized student debtors today in Washington, DC to march to Sallie Mae and the Department of Education carrying a giant ball of student debt. Many marching were Baby Boomers still in debt.