Tag Results

168 posts tagged Default: the Student Loan Documentary

168 posts tagged Default: the Student Loan Documentary

Years ago I went to college to study accounting, and like millions of other Americans I took out loans to pay for it. A few years later I got a temporary job in the accounting department at Bain & Co., and after 6 months of reliable work I was thrilled to be offered a full-time position.

However, just a few weeks after starting in my new position the company fired me because my debt-to-credit ratio was too high. I later learned that 60% of employers now check credit reports, which typically include student debts. How are you supposed to pay off your student debts if you can’t get (or keep) a job BECAUSE of your debts? And what do my student debts have to do with my ability to do a job well anyway?

25 states have debated bills in the last year to restrict this practice, and in a number of these states one company has fought hardest against these efforts: credit reporting company TransUnion.

What’s ironic is that Penny Pritzker, TransUnion’s Chair and part owner, sits on President Obama’s Jobs and Competitiveness Council, which advises the President on putting Americans back to work. How can someone advise on national job creation when her company sells products that may keep qualified people out of work?

Please join me and 25 national civil rights organizations in calling on TransUnion to stop its sale of credit reports to employers. As the only one of the “Big 3” credit reporting companies that’s privately held, TransUnion has the ability to stop this practice overnight.

It was recently announced that in the coming weeks TransUnion will be sold to two private equity companies, including Goldman Sachs. If Penny Pritzker is serious about job creation, she should do what she can to ensure that her company stops this abusive practice before the company is sold.

Click HERE to sign Latoya’s Change.org petition

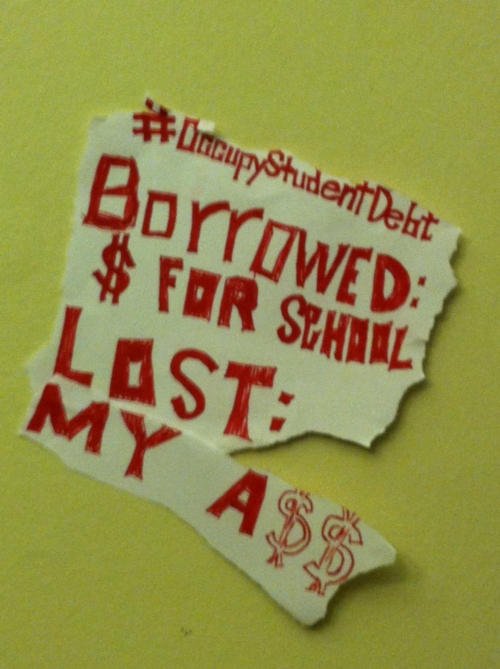

Pls RT: what does my student debt have to do w/ my ability to do my job?

#StopTransUnion #OccupyStudentDebt #UniteHere

http://www.change.org/petitions/transunion-stop-selling-credit-reports-to-employers

Who is YOUR Representative? Work with Occupy Student Debt and Forgive Student Loan Debt to petition EVERY Representative to support HR 4170. Start your own petition urging YOUR Representative to support the Student Loan Forgiveness Act of 2012.

Dear Representative ________,

My name is _________, and as one of your constituents, I urge you to support H.R. 4170 The Student Loan Forgiveness Act of 2012. Like so many other young people, I borrowed money for school and I’m drowning in debt. I borrowed ________, paid ________ and still owe_____. With 2/3 of college students borrowing money for school and 1 out of 5 defaulting on their student loans, we clearly need serious and swift action. We are suffering and want to contribute to society but we’re drowning in debt.

Rep _______, please support ending indentured servitude and support the Student Loan Forgiveness Act of 2012 (HR 4170).

In 2010 something unthinkable happened – student debt surpassed credit card debt as the largest form of debt in this country, passing $800 billion dollars. In 2012 more history will be made as the amount of unpaid student debt climbs to $1 trillion dollars, with an additional $1 million dollars added to that number every 6 minutes.

The ripple effect that this has on our economy is crushing: students and recent graduates are forced into low-wage jobs in order to immediately start making payments back to banks and lenders; instead of stimulating the economy by spending millions of dollars, students and graduates are pinching pennies to just try to keep up with the interest on their loans; and the privatization of colleges and universities are expedited as the same loan agencies use the profit off of students to lobby for lower tax rates, forcing budget cuts to higher education in an economy where recent graduates struggle to find jobs.

Imagine students not working two part-time minimum wage jobs as they struggle to get through school, allowing them more time to participate in civic engagement. Imagine recent graduates not being pushed into a job market where they are forced to intentionally keep wages stagnant, allowing them the ability to work for non-profits or local businesses.

If we do not solve the student debt crisis the students of today will suffer, but the students of tomorrow may never have the opportunity to a college education. A generation of students will pay the hefty price of their student loans; but we must not forget that we will also pay the debt of an entire country ignoring the burden placed on those working to better their lives and communities by obtaining a college degree.

Does YOUR representative support Hansen Clarke’s Student Loan Forgiveness Act of 2012 (H.R. 4170)???

http://www.change.org/petitions/rep-mike-mcintyre-support-the-student-loan-forgiveness-act-of-2012-hr-4170

Student debt an issue with the Baby Boomers too!

Even as total outstanding student debt rises to $1 trillion, lawmakers have yet to allow loans to be discharged in bankruptcy.

Without an escape clause, these loans can strangle a person.

Take 36-year-old Nick Keith, who remains $142,000 eight years after graduating from culinary school. He’s featured in a new film, DEFAULT: The Student Loan Documentary, in which several college graduates expose the pitfalls of the private student loan industry.

A terrorist organization has nothing on Citibank.

I co-signed the private student loans for both of my children with no doubt in my mind at the time that they would be able to re-pay the loans. Then 2008 happened. My daughter graduated in 2010 with a BFA; my son completed his Masters the same year.

The only job my daughter has had since her graduation is in a retail art supply store at $10 an hour; my son accepted a job teaching English in China last August when all of his attempts at securing employment in the US failed. Although his wages are adequate for life in China, in American currency it’s equal to about $800 a month.

I lost my job in 2008 and since have vacillated between temporary employment and unemployment. After three years, I managed to scrape enough money together to file for bankruptcy. In the process, my house almost went into foreclosure. After being turned down under the “Make Home Affordable Plan” (for not having sufficient income…the very reason I applied), I contacted a person from HUD, and (magically), it was approved, so I know the importance of having an advocate.

Both my son and daughter pay their Citibank loans every month without fail; they just can’t pay the exorbitant amount they’re requesting. Both of them had their federal loans deferred without a problem. Both of them have called Citibank so many times, we’ve lost count. They continue to send letters asking them to call to make arrangements, but when they do, they are told that they can only help with the federal loans, not the private. Citibank personnel have told us that it makes no difference what their incomes are, or even if they have an income; they still have to make these huge payments each month.

We are barraged with constant phone calls, emails, regular mail and, at least twice a week, hand delivered UPS threatening letters. Because I am the co-signer, I receive the same amount of harassment as my children. After going through all the expense and trauma of bankruptcy, because student loans are non-dischargeable, Citibank continues their relentless psychological warfare on me and my family (and I’m sure, hundreds of thousands of others).

Citibank referred my daughter’s loans to a debt collector. After this debt collector contacted one of our neighbors (appalling!), she sent a “cease and desist letter”. After sending that letter, the same debt collector called a different neighbor (isn’t this illegal?!!) asking for me, as they’ve now referred my son’s loans to the same debt collection agency. Now I’ve had to send another “cease and desist” letter. These are loans both my son and daughter make payments on every month.

When President Obama spoke last October in Denver addressing the issue of student loan debt, we felt slightly hopeful, but I’ve heard nothing since that time regarding this issue. He was proposing that all student loans (federal and private) be consolidated, and there would be one payment, not to exceed any more than 10% of an individual’s disposable income. When my kids heard this, they both said, “I could do that.” They could do that; they can’t do this. I can’t do this – dealing with the constant threats and harassment. My son’s, my daughter’s and my credit is completely ruined. I am in desperate need of a newer car, but even though I am now employed, I can’t get a car loan after what Citibank has done to us.

I hear these same stories from my children’s friends and my friends’ children. Most of them are living at home again because they can’t rent an apartment; they can’t buy a car. They cannot do any of the things that young adults should be able to do, because these loan sharks are asking for 75% of their income.

Support H.R. 4170 - The Student Loan Forgiveness Act of 2012

Greetings,

I just signed the following petition addressed to: Rep. John Kline, The U.S. Congress & President Obama.

————————

Support H.R. 4170 - The Student Loan Forgiveness Act of 2012

Since 1980, average tuition for a 4-year college education has increased an astounding 827%.

Since 1999, average student loan debt has increased by a shameful 511%.

In 2010, total outstanding student loan debt exceeded total outstanding credit card debt in America for the first time ever.

In 2012, total outstanding student loan debt is expected to exceed $1 Trillion.

In short, student loan debt has become the latest financial crisis in America and, if we do absolutely nothing, the entire economy will eventually come crashing down again, just as it did when the housing bubble popped. Reasonable minds can disagree as to the solutions, they cannot, however, disagree on the existence of this ever-growing crisis, as well as the unsustainable course we’re on towards financial oblivion.

As a result of more than 30 years of treating higher education as an individual commodity, rather than a public good and an investment in our collective future, those buried under the weight of their student loan debt are not buying homes or cars, not starting businesses or families, and they’re not investing, inventing, innovating or otherwise engaged in any of the economically stimulative activities that we need all Americans to be engaged in if we’re ever to dig ourselves out of the giant hole created by the greed of those at the very top.

Now for the good news: there’s finally hope on the horizon!

Representative Hansen Clarke of Michigan has just introduced H.R. 4170, The Student Loan Forgiveness Act of 2012, in the House of Representatives - legislation designed to lend a helping hand to those struggling under massive amounts of student loan debt.

For a brief summary of H.R. 4170’s main provisions, please copy & paste this URL into your browser: http://tinyurl.com/7akydbk

To read the full version of the actual bill itself, please go here: http://tinyurl.com/6txure8

To read answers to some of the most frequently asked questions about The Student Loan Forgiveness Act of 2012, please go here: http://tinyurl.com/8xh4csd

Student loan debt has an undeniable and significant suppressive effect on economic growth. The Student Loan Forgiveness Act of 2012 directly addresses this enormous boot on the neck of the middle class and represents a glimmer of hope for millions of Americans who, with each passing day, find that the American Dream is more and more out of reach.

Therefore, we, the undersigned, respectfully request that Congress bring H.R. 4170, The Student Loan Forgiveness Act of 2012, up for consideration and commit to holding a straight, up-or-down vote on it this year. Thereafter, we, the undersigned, respectfully request that President Obama sign this legislation into law.

What is needed is not blind subservience to the banksters and millionaire-run, corrupt colleges, what’s needed is a new higher educational system that is not designed to fleece people and put them in lifelong debt.

Clearly the current educational system has been infiltrated and taken over by the banksters and others with a Neoliberal, corporatist agenda. They have locked down 95% of the educational system, turning it into a debt slave factory. The American Empire has inflicted debt slavery on entire countries throughout the world, so there should be no surprise that they’ve done it here at home.

But it need not be this way. Educators reading this: You can take the initiative to begin new colleges that do away with nonsense like luxury student apartments, football teams, millionaire executives and all other unnecessary burdens. Bare minimum schools like we used to have are as possible today as they were in the 1970’s.

Your charge is to not just liberate the mind, but the person as well. Debt slavery is antithetical to the true purpose of academia.