Tag Results

15 posts tagged student loan debt

15 posts tagged student loan debt

Even as total outstanding student debt rises to $1 trillion, lawmakers have yet to allow loans to be discharged in bankruptcy.

Without an escape clause, these loans can strangle a person.

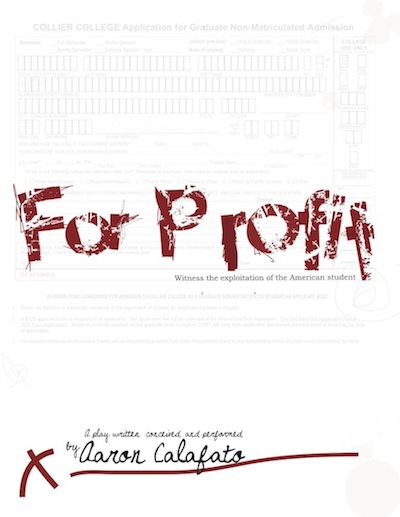

Take 36-year-old Nick Keith, who remains $142,000 eight years after graduating from culinary school. He’s featured in a new film, DEFAULT: The Student Loan Documentary, in which several college graduates expose the pitfalls of the private student loan industry.

I borrowed $5,000 in 1987 to attend a professional makeup artistry school in Covina, California. I graduated and eventually began making payments. I had a divorce and finally they garnished my wages from my job in the entertainment industry. I continued to pay them until I had the amount down under $1,000. I had some difficult years and put the payments on hold with deferments, etc. Three months ago I received the amount now owed was over $5,000 due to interest occurring. This was a loan that I took out in 1987 and was almost paid off and now has a balance over the original amount. This is 2011. I refuse to pay them all over again as I am now retired and living on social security and work with my art and whatever part time job I can find. They want me to pay back what I have already paid them. This is robbery and stealing from the American people. I have read some of the other stories and I am in awe that the banks have been allowed to create a complete business scam scheme out of the education system. I also was going to attend an online school in 2005, but backed out before I began my courses. I received a bill from a bank for $150 for the enrollment fee that was paid to a school that I never attended. I was paying them $5.00 a month for awhile and then realized I was paying for a service that I never used. This is robbery. Occupy!

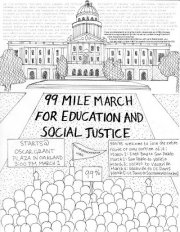

We came. We marched. We were arrested for standing up for what’s right.

# # #

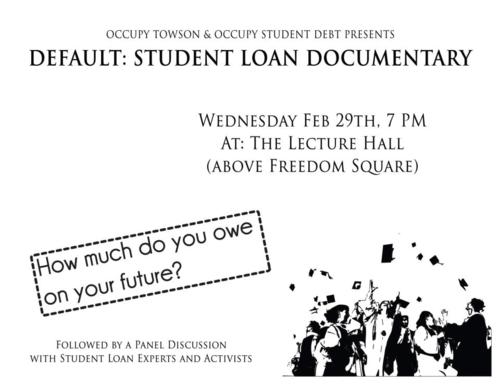

Today almost 60 campuses are showing DEFAULT: The Student Loan Documentary for the Student Debt Week of Action. Thank you to Occupy Towson University for showing the film and for your solidarity!

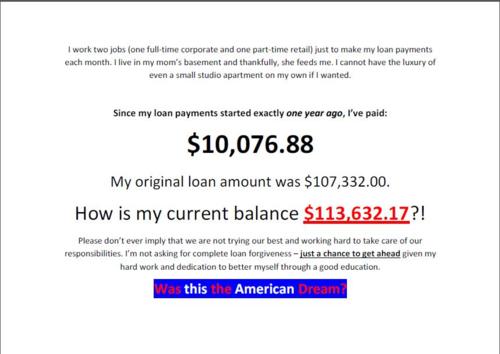

This is what my hard work got me.

Justice? I became disabled 15 years ago and filed bankruptcy due to the ensuing financial disaster, but student loan debt. could not be discharged. I was urged to consolidated my student loan debt through a ‘program’ offered by the Justice Dept: after 1o years of payments my remaining debt was to be discharged. I made payments for 5 years, but then started being hounded by Dept. of Ed for my SL debt. The bottom line is: the Justice Dept. ONLY SENT $125.00 out of the $3000.00 I paid to them to the Dept. of Ed. to be applied to my debt! In the meantime, with fees and interest my debt had nearly DOUBLED. The Justice Dept. refuses to explain what they did with the 2875.00 I paid them: in fact, because I dared to complain about this outrageous treatment, they are now garnishing 15% of my disability income. This is a severe hardship for me, not only financially: my trust in anything the U.S. government says is gone. Justice? Not for poor disabled citizens.

Between July and September, Sallie Mae spent $550,000 lobbing Congress, the Federal Deposit Insurance Commission, Federal Reserve System and Treasury Department.

WHY???

I am in my 60s and finally paying off my student loans, but it took decades. I’ve had thoughts of loan collectors deducting payments from my social security checks when I retire or standing over my grave with an I.O.U.

In the late 60s I went to the University of Illinois to get a B.A. and tuition, fees and housing were affordable. I was also active in the vibrant political movements of the 60s and 70s and learned about the unfair nature of the economic system in which we live and work.

Politicians and predatory lenders like Sallie Mae have gradually dismantled the state land-grant system of colleges put in place when Lincoln was President. They also have chipped away at free or low-cost state systems like CUNY in New York or SUNY in California.

When I went graduate school in the 80s at Northeastern Illinois University, costs were dramatically higher. Ironically, I was enrolled in a Social Science Program with a major in Womens’ Studies but could not afford the expenses. I was a single parent with two daughters and, even with student loans, I could not pay rent, child care at the college, and other costs. Physically, I could not work part-time, attend classes and raise two children by myself. 1%ism already existed in higher education.

I left graduate school to get a full-time job. I had Dystonia which affects my speech. Many employers openly discriminated against me and I took out forbearances on my student loans which accelerated the amount of interest. The only treatment for Dystonia is bo-tox injections in the vocal cords by a skilled Neurologist or ENT Doctor. I had neither medical insurance or a job and getting a job was made more difficult by not having medical treatment for my voice.

I finally got a job and have nearly paid off the student loans, but the money I’ve paid in interest alone could have been used in a more socially beneficial way such as sending my daughters or other young people to college.