Tag Results

125 posts tagged nelnet

125 posts tagged nelnet

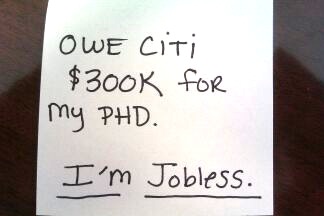

How can I pay this if I can’t find a job and can’t afford to move to get one outside of my city? I should have just disappointed generations before me and not gone to college.

Years ago I went to college to study accounting, and like millions of other Americans I took out loans to pay for it. A few years later I got a temporary job in the accounting department at Bain & Co., and after 6 months of reliable work I was thrilled to be offered a full-time position.

However, just a few weeks after starting in my new position the company fired me because my debt-to-credit ratio was too high. I later learned that 60% of employers now check credit reports, which typically include student debts. How are you supposed to pay off your student debts if you can’t get (or keep) a job BECAUSE of your debts? And what do my student debts have to do with my ability to do a job well anyway?

25 states have debated bills in the last year to restrict this practice, and in a number of these states one company has fought hardest against these efforts: credit reporting company TransUnion.

What’s ironic is that Penny Pritzker, TransUnion’s Chair and part owner, sits on President Obama’s Jobs and Competitiveness Council, which advises the President on putting Americans back to work. How can someone advise on national job creation when her company sells products that may keep qualified people out of work?

Please join me and 25 national civil rights organizations in calling on TransUnion to stop its sale of credit reports to employers. As the only one of the “Big 3” credit reporting companies that’s privately held, TransUnion has the ability to stop this practice overnight.

It was recently announced that in the coming weeks TransUnion will be sold to two private equity companies, including Goldman Sachs. If Penny Pritzker is serious about job creation, she should do what she can to ensure that her company stops this abusive practice before the company is sold.

Click HERE to sign Latoya’s Change.org petition

Pls RT: what does my student debt have to do w/ my ability to do my job?

#StopTransUnion #OccupyStudentDebt #UniteHere

http://www.change.org/petitions/transunion-stop-selling-credit-reports-to-employers

I am 33 years old and currently have $25,000 worth of student loan debt. The majority of my student loans are private loans from Sallie Mae. I’ve been paying back these loans since 2008 and my principal balance has not decreased. It sucks the interest rates on student loans are so high.

The weight of student loan debt makes it harder for students to further their education and it’s a disservice to society. Why are people being punished for furthering their education? When people are educated there is a greater chance they will become productive citizens. There has to be student debt reform!

Recently, Congresswoman Virginia Foxx raised eyebrows when she expressed her lack of sympathy for those who are currently drowning in student debt. Foxx, 68, makes the assertion that she was able to attend college and she “never borrowed a dime” in her seven years it took her to finish her undergraduate degree.

How is her college experience even remotely relevant to students of today? It’s not. In fact, she is just another example of a cancerous bureaucrat that is infecting Congress and a great example of why so many Americans today no longer trust our government. Instead of fighting for her constituents, she seems to be waging a war against them. She also fails to acknowledge that when she was graduating from college in 1968, according to the University of Minnesota, students only needed to work a minimum wage job just over six hours a week to afford college tuition. Foxx, a former college professor and community college president, also seems to forget that since 1978, college tuition has skyrocketed by over 900%, outpacing inflation by 650 points.

So why might Foxx be waging war on education? Look no further than her cozy relationship with Sallie Mae and the thousands of dollars in campaign contributions from Sallie Mae, Nelnet and the fact that 76% of the time she votes in favor of her campaign donors.

Current balance, $175,000. Original Principle was $120,000. Administered by Sallie Mae and National Collegiate Trust (American Education Services) I imagine in the next few years it will be a quarter million.

I’ve never been able to touch the principle since i started paying. I struggled finding a job for 2 years after school, and my interest skyrocketed during forbearance and deferment.

Now i finally have a well paying job as a graphic designer, and i still struggle. My job is very demanding, i work long hours, and usually have to take side work to make due. I mostly live paycheck to paycheck, my monthly payments equal around another month’s rent, about $1200. I also suffered two great family losses in one year, had to move, and had some health problems. Which put a huge financial burden on my life. Sallie Mae and National Collegiate Trust have no sympathy or understanding for their customers. At this point i’m so far behind payments, I have no idea how i’m going to catch up. I get about eight phone calls a day harassing me for money i don’t have, threatening to sue me, and unwilling to work around my pay schedule or income. It’s humiliating, demoralizing, and disruptive. This disturbance and added stress makes it difficult to concentrate on my work, and takes a toll on my general well being. I’ve even had the collections agencies (who are owned by the lenders) make harassing phone calls to my office, extended family, and even friends.

At 19, had i known my education was going to cost me over a quarter million dollars, i would have made other arrangements. But the schools are payed by these lenders to sell you these loans, and they sell that dream of success really well. My only hope now is that my family and I remain in good health and hopefully the laws change soon.

This week we worked with The Backbone Campaign for the Student Debt Jubilee action in Washington, DC.

I borrowed $5,000 in 1987 to attend a professional makeup artistry school in Covina, California. I graduated and eventually began making payments. I had a divorce and finally they garnished my wages from my job in the entertainment industry. I continued to pay them until I had the amount down under $1,000. I had some difficult years and put the payments on hold with deferments, etc. Three months ago I received the amount now owed was over $5,000 due to interest occurring. This was a loan that I took out in 1987 and was almost paid off and now has a balance over the original amount. This is 2011. I refuse to pay them all over again as I am now retired and living on social security and work with my art and whatever part time job I can find. They want me to pay back what I have already paid them. This is robbery and stealing from the American people. I have read some of the other stories and I am in awe that the banks have been allowed to create a complete business scam scheme out of the education system. I also was going to attend an online school in 2005, but backed out before I began my courses. I received a bill from a bank for $150 for the enrollment fee that was paid to a school that I never attended. I was paying them $5.00 a month for awhile and then realized I was paying for a service that I never used. This is robbery. Occupy!

Every day I wake up with dread going to a job I do not like. In fact, a career I do not like. Why? Because of student loan debt.

Original principal: $65K

Paid thus far: $25K

Currently owe: $125K

I wish I had been born in Europe.

I have a Master’s Degree and over $100,000.00 in student loans. The interest on my loans is approximately $600.00 per month. At the present my loans are in economic deferment.

I am an adjunct professor at a community college. I make $1750.00 per class, per semester; after taxes that is about $1550.00. Thus, in a sixteen week semester –five months if I teach two classes I will take home $3100.00. I do not have benefits. I have taught three classes in a semester but normally I teach two classes. As a part-time adjunct I cannot teach more than four classes. I would make more working at MacDonald’s in a four hour week. However, minimum wage employers are reticent to hire people such as myself since they assume that we will only stay until I find a better position.

Obviously I can neither afford to pay back my loans or support myself.

I live in blue collar part of the Midwest. In other words, having an advanced degree is more of a hindrance in the job market in my immediate area than it is helpful. I am fortunate that I am married and therefore I am not out on the street starving. My husband [a disabled veteran] who recently earned his Associates of Arts supports the family on his $15.75 hourly wage.

I do not want my loans forgiven. I just want a job that will allow me to contribute to my community, my country and pay back my loans before I am 80 years old. I fail to see the logic in charging me $600.00 a month interest with a myriad a different interest rates. The taxpayers are not benefitting from these charges. Although I try to remain positive and keep searching for full time employment it may be years before the taxpayers even begin to recoup the interest on my loans—never mind the principle.

The system needs to be changed NOW! Here are my suggestions for changing the system:

1. While in school, the interest rates for unsubsidized and subsidized Federal student loans should be two percent.

2. Three percent should be the ceiling once out of school.

3. There should be one constant rate for Federal Student loans.

4. These rates should come up for review every ten years and be authorized by Congress if there is to be a rate increase.

5. If a borrower is out of work for more than a twelve month period the accruing interest should freeze.

6. Once gainfully employed at a full time job [that is not minimum wage] the employer must report the status of the employee after the first ninety days. Re-payments will begin after the first ninety days.

7. For those of us with Master Degrees and above who have outstanding student loans over $50,000.00 the Government should commence an incentive program [a tax break per employee] that would encourage companies to hire job seekers with advanced degrees.

8. Government Agencies that are behind in their workload for example the State Department [paper work for immigration and non-status residents] the Veterans Administration, should have programs that allow those with Advanced Degrees who have been unemployed for more than a twelve month consecutive period or have been employed only part-time for a twelve month consecutive period who like myself cannot find full time to work that allows the borrower to be self-supportive and pay back loans part-time volunteer for positions in said agencies. Minimal loan forgiveness would be allotted per quarter. This would not only allow for better customer service from these agencies but would give those borrowers a sense of satisfaction, alleviate stress regarding loans, give back to the community and country and be a source of experience and resume filler.

I graduated last year with a degree in Medical Assisting. Since then, jobs that are posted require at least one year’s work experience in that field. How do I get the experience if I can’t get the job??

Needless to say, I have not be able to use my expensive college degree and have to work part-time caregiving for less than I would make at McDonald’s. I simply can’t make the payments on my student loans, I feel like I am in bondage. The schools flooded the market with students, there should be a way to stop schools from selling these degrees.

I currently owe $35,000, interest rates from 6.45 % on up. It will take me over 20 years to pay, if I had the money, and, as a student who had to start a second career, I will be in my 70’s. I have loans with American Education Services, Sallie Mae, Federal Loan Servicing and Wells Fargo.

In order to keep working, I also need an engine for my car. Guess what comes first, the car or the loans? Something needs to be done to forgive loans for those of us who have tried and just can’t get into the job market due to such a thing as lack of work experience. There’s just no way around it.

Thanks to all who are working to fight this injustice for those of us who had a dream!