Tag Results

113 posts tagged occupy sallie mae

113 posts tagged occupy sallie mae

Are YOU ready? Better be…We’ve partnered with Occupy Colleges, Backbone Campaign, Rebuild the Dream, Occupy Together, OWSpr, Project on Student Debt, DEFAULT: The Student Loan Documentary, and ForgiveStudentLoanDebt.com and others to bring everyone Occupy Graduation!

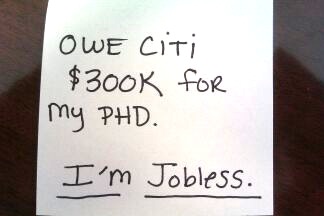

What to do? Sallie Mae is taking me to “legal” now. They have cashed my little checks each month, but won’t put it towards the $150 that it costs to defer the loan. They can only accept one check to do that whether I have paid $150 already, but it was several payments and not on one check. Who else does this? Will my loans be forgiven if this law passes and I’m already in “legal” which I guess means I’ll be with another bill collector?

How can I pay this if I can’t find a job and can’t afford to move to get one outside of my city? I should have just disappointed generations before me and not gone to college.

I have been reading the argument on how people sign the contract and should be liable for their debt they are incurring from their student loans. How many actually read the document and how many were encouraged by television ads and other media or even friends and counselors at school that getting a higher education is the way to go. I realize now that higher education was a wonderful thing, however not worth the cost of it. Education in this country should be free, then we would not care as much how terrible our politicians are today and how worthless our government is as a whole. People need to stand up for what they believe and wake up to what is happening.

Years ago I went to college to study accounting, and like millions of other Americans I took out loans to pay for it. A few years later I got a temporary job in the accounting department at Bain & Co., and after 6 months of reliable work I was thrilled to be offered a full-time position.

However, just a few weeks after starting in my new position the company fired me because my debt-to-credit ratio was too high. I later learned that 60% of employers now check credit reports, which typically include student debts. How are you supposed to pay off your student debts if you can’t get (or keep) a job BECAUSE of your debts? And what do my student debts have to do with my ability to do a job well anyway?

25 states have debated bills in the last year to restrict this practice, and in a number of these states one company has fought hardest against these efforts: credit reporting company TransUnion.

What’s ironic is that Penny Pritzker, TransUnion’s Chair and part owner, sits on President Obama’s Jobs and Competitiveness Council, which advises the President on putting Americans back to work. How can someone advise on national job creation when her company sells products that may keep qualified people out of work?

Please join me and 25 national civil rights organizations in calling on TransUnion to stop its sale of credit reports to employers. As the only one of the “Big 3” credit reporting companies that’s privately held, TransUnion has the ability to stop this practice overnight.

It was recently announced that in the coming weeks TransUnion will be sold to two private equity companies, including Goldman Sachs. If Penny Pritzker is serious about job creation, she should do what she can to ensure that her company stops this abusive practice before the company is sold.

Click HERE to sign Latoya’s Change.org petition

Pls RT: what does my student debt have to do w/ my ability to do my job?

#StopTransUnion #OccupyStudentDebt #UniteHere

http://www.change.org/petitions/transunion-stop-selling-credit-reports-to-employers

Follow us on TWITTER

——»> @OWSstudentDebt

By Denise Smith, Kasey Oliver, and Ryan Jacobi in ForgiveStudentLoanDocumentary.com

H.R.4170 Campaign - What every member should do to get involved in the H.R.4170 Campaign!

Pease register at the www.forgivestudentloandebt.com Website! Stay up to date on all the latest FSLD news and share your story and participate in the forums!

#1 Petitions!!!

Sign the following petitions created by Robert Applebaum, Esq., founder of forgivestudentloandebt.com, asking Rep. John Kline (MN), The United States House of Representatives, The United States Senate, and President Barack Obama to Support the Student Loan Forgiveness Act of 2012 (H.R.4170):

Please also sign the following petitions in support of H.R.4170 created by members of the student loan community:

#2

Weigh in at PopVox by clicking on “support” and send a message to your representative. (There is a character limit of around 1500 for your comments)

https://www.popvox.com/bills/us/112/hr4170

#3

Go to OpenCongress and click the green “support” check mark, upper right side of page and send a message to your Representative and Senators—you also can print a copy for mailing.

http://www.opencongress.org/bill/112-h4170/show

#4

Mail a letter to your Representative strongly urging them to co-sponsor and support this bill! Tell them why you support H.R.4170, what its passage would mean to you personally and how it would benefit the economy!

Find contact Information: http://www.contactingthecongress.org/

#5

Call your Representative and strongly urge them to co-sponsor and support this bill!

Tell them why you support H.R.4170, what its passage would mean to you personally and how it would benefit the economy!

Find Your Representatives/Senators at http://www.contactingthecongress.org/

#6 If there is are open seats in your state, contact the candidates to ask them what their position is and encourage them to support H.R.4170.

Look here to locate them: http://www.politics1.com/states.htm

#7

Email your friends, family members and everyone you know!

Send them this petition link:

Ask them to sign. Tell them your story and explain how H.R.4170 will benefit not only borrowers but also our economy!

#8

If you are on twitter, tweet the following message to your followers:

#9

If you are on Facebook, copy & post the following message on your wall:

#10

If you are on other social networking sites please reach out there as well. The more we reach out, the more likely we are to hit our goal of 1 million signatures!

#11 Ready to take a really BIG step? Write to every last Representative in Congress. Set a daily goal and work down this list:

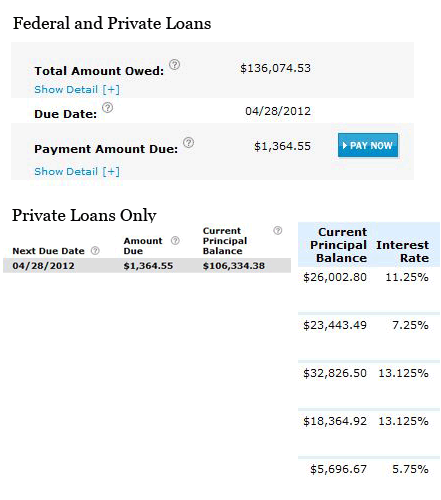

I took out $60,000 in private student loans initially. This included living costs, lab costs and materials costs. Since I graduated in 2005, this has ballooned to $107,000. I pay $1350 a month simply to one set of private student loans from Sallie Mae.

They absolutely refuse to work with me. If I wasn’t lucky enough to find a “decent” paying job, I would still be behind on these bills. It took me years to even be caught up at all — in the process hurting my credit and demolishing my debt to income ratio. Actually owning anything seems like a pipe dream.

I took out $60,000 in private student loans initially. This included living costs, lab costs and materials costs. Since I graduated in 2005, this has ballooned to $107,000. I pay $1350 a month simply to one set of private student loans from Sallie Mae. These are not the only loans I have, yet they account for over 50% of my monthly income. The interest alone is somewhere around $1000 per month.

If I wasn’t lucky enough to find a “decent” paying job, I would still be behind on these bills. It took me years to even be caught up at all — in the process hurting my credit and demolishing my debt to income ratio. Actually owning anything seems like a pipe dream.

Sallie Mae generally refuses to work with me. I sometimes get calls saying they want to help — the only question asked if how I will be paying. If I’m late, the website displays threatening messages about how they can ruin my life and garnage my wages. The only time they EVER even have attempted to play fair was after I filed a formal complaint with the CFPB.

One thing I think is often ignored is the role the school plays in this. My school, IADT Chicago, instantly whipped out Sallie Mae paperwork the second financial aid was mentioned. They actively discouraged using other lenders, essentially making me feel like a criminal when I tried to do so.

I feel punished for going to school. To expect a 17/18 year old to fully understand a system that so directly misleads and intimidates them is insane.

Protesting student debt usury??? Sallie Mae want YOU to know that their security is watching YOU (even if you are not on their property).

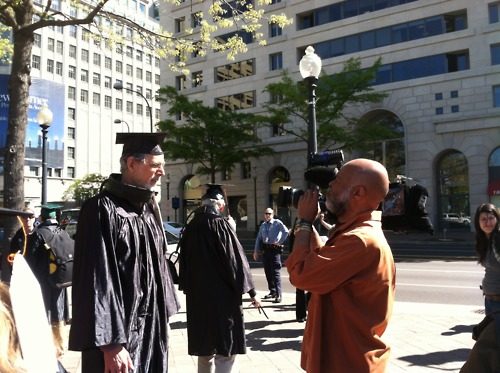

Baby Boomers saddled with debt! The Backbone Campaign organized student debtors today in Washington, DC to march to Sallie Mae and the Department of Education carrying a giant ball of student debt. Many marching were Baby Boomers still in debt.