Tag Results

626 posts tagged submission

626 posts tagged submission

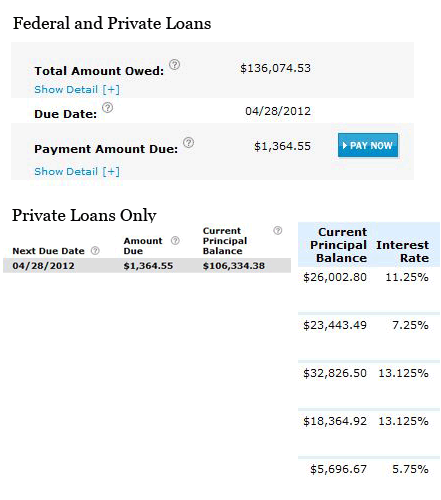

I took out $60,000 in private student loans initially. This included living costs, lab costs and materials costs. Since I graduated in 2005, this has ballooned to $107,000. I pay $1350 a month simply to one set of private student loans from Sallie Mae.

They absolutely refuse to work with me. If I wasn’t lucky enough to find a “decent” paying job, I would still be behind on these bills. It took me years to even be caught up at all — in the process hurting my credit and demolishing my debt to income ratio. Actually owning anything seems like a pipe dream.

I took out $60,000 in private student loans initially. This included living costs, lab costs and materials costs. Since I graduated in 2005, this has ballooned to $107,000. I pay $1350 a month simply to one set of private student loans from Sallie Mae. These are not the only loans I have, yet they account for over 50% of my monthly income. The interest alone is somewhere around $1000 per month.

If I wasn’t lucky enough to find a “decent” paying job, I would still be behind on these bills. It took me years to even be caught up at all — in the process hurting my credit and demolishing my debt to income ratio. Actually owning anything seems like a pipe dream.

Sallie Mae generally refuses to work with me. I sometimes get calls saying they want to help — the only question asked if how I will be paying. If I’m late, the website displays threatening messages about how they can ruin my life and garnage my wages. The only time they EVER even have attempted to play fair was after I filed a formal complaint with the CFPB.

One thing I think is often ignored is the role the school plays in this. My school, IADT Chicago, instantly whipped out Sallie Mae paperwork the second financial aid was mentioned. They actively discouraged using other lenders, essentially making me feel like a criminal when I tried to do so.

I feel punished for going to school. To expect a 17/18 year old to fully understand a system that so directly misleads and intimidates them is insane.

I borrowed about $120,000 for law school (and had a little over 10k from undergraduate school), graduating in 2009.

I currently owe approximately $175,000. My daily interest is $31.56. I barely make that much after taxes!

Over $50,000 dollars in loans are graduate loans with an interest rate of 8.5%. My credit was in the mid 700’s when the government/ banks issued the loans to me- at such a high percentage rate.

My loans fell into default and the lender said that, unless I agreed to capitalize the interest or pay two past due payments, they would have to keep me in default. The lender bombards me with emails regularly, and I did not receive notice to resubmit my Interest-Based Payment application from the lender because I assumed it was an advertisement- one of the many encouraging me to go back to school and take out more loans. My license can be revoked for falling into default on my student loans. I was underemployed and did not have the thousands of dollars necessary to bring the loans current (yes, two months resulted in over 3k in payments due). Thus, I had no choice but to agree that I would be charged interest on interest at between 6.8 and 8.5% on over 100k in debt in order to convince the lender to review my income based repayment options and reinstate my loan to good standing.

A system that puts a young person in this situation is wrong. I am not asking for the right to file bankruptcy. I am simply asking that the government either cap the loans or give an honest and reasonable interest rate. Furthermore, capitalization should NEVER be required to bring you loan into good standing. This seems like an UNFAIR AND DECEPTIVE TRADE PRACTICE.

I feel like I have done everything right, have been lied to by society, and am a prisoner to my debt. I am not alone. My best friend owes $60,000 at 9.5%, with her mother as a co-borrower, and she works as a preschool teacher.

If your license does not require good-standing on your student loans to maintain it, why would you not default in my situation? As a debt settlement/ collections attorney, I do not have that option. The Florida Bar will take my license if I default. Despite that, it is an option that crosses my mind every single day that I work 12 hours a day- six days a week! I love my job as much as I love my husband. I can’t imagine giving up the right to help people out of debt because I couldn’t manage to pay mine. But, at the end of the day, I know I can’t go to jail for not paying my debt. So, I will keep slaving away to pay. But I pray that the rest of the world will not, and will force change on this ridiculously corrupt system.

After completing my first semester at the University of Michigan in 2001, I was assaulted and suffered a closed head / mild traumatic brain injury. It was recommended by my doctors that I continue with school – exercising my brain was the best chance I had at recovering. And so, I went right back to Michigan.

In my following semesters there, I struggled in my classes. I began to lose scholarships and turned more and more to student loans as time went by. After several years, I recovered, but I still had to pay for classes that I ended up not getting any credit for in the meantime – the university expunged classes I failed due to my circumstances. I tried four different schools to complete my degree, though for about a year and a half had given up and joined the workforce, then later returned to college and finally graduated from Wayne State University in 2009.

Today, my family and I can barely make ends meet. I have a student loan debt, with interest, of about $190,000. I obtained a judgment against my assailant for $250,000, but of course he’s unable to pay that amount, and I currently receive about $160 every quarter.

I’m 28 and can’t look forward to when I may ever be able to afford to move out of my parents’ house. They generously help as much as they can and had to file bankruptcy on their other debt to keep up with my loans – they are cosigners for my private loans. My dad retired ten years ago, but took on another job and goes garbage picking nearly every night to find metal and hidden treasures to sell.

When I took out the loans, I was focused on healing, gaining financial independence and moving forward from the assault. While going to school helped me recover, and was a necessary means to this end, the student loans have added insult to injury and severely prolonged my suffering and attachment to the horrific incident that caused my college career to take so much money and time from me and my family in the first place.

—-Approximate Original Amount Borrowed: $135,000 federal and private.

—-Approximate Current Balance: $190,000 federal and private ($170k private - $20k federal).

Total Payments made—-4,527.82

Original loan—-40160.27

Outstanding balance—-35344.56

A terrorist organization has nothing on Citibank.

I co-signed the private student loans for both of my children with no doubt in my mind at the time that they would be able to re-pay the loans. Then 2008 happened. My daughter graduated in 2010 with a BFA; my son completed his Masters the same year.

The only job my daughter has had since her graduation is in a retail art supply store at $10 an hour; my son accepted a job teaching English in China last August when all of his attempts at securing employment in the US failed. Although his wages are adequate for life in China, in American currency it’s equal to about $800 a month.

I lost my job in 2008 and since have vacillated between temporary employment and unemployment. After three years, I managed to scrape enough money together to file for bankruptcy. In the process, my house almost went into foreclosure. After being turned down under the “Make Home Affordable Plan” (for not having sufficient income…the very reason I applied), I contacted a person from HUD, and (magically), it was approved, so I know the importance of having an advocate.

Both my son and daughter pay their Citibank loans every month without fail; they just can’t pay the exorbitant amount they’re requesting. Both of them had their federal loans deferred without a problem. Both of them have called Citibank so many times, we’ve lost count. They continue to send letters asking them to call to make arrangements, but when they do, they are told that they can only help with the federal loans, not the private. Citibank personnel have told us that it makes no difference what their incomes are, or even if they have an income; they still have to make these huge payments each month.

We are barraged with constant phone calls, emails, regular mail and, at least twice a week, hand delivered UPS threatening letters. Because I am the co-signer, I receive the same amount of harassment as my children. After going through all the expense and trauma of bankruptcy, because student loans are non-dischargeable, Citibank continues their relentless psychological warfare on me and my family (and I’m sure, hundreds of thousands of others).

Citibank referred my daughter’s loans to a debt collector. After this debt collector contacted one of our neighbors (appalling!), she sent a “cease and desist letter”. After sending that letter, the same debt collector called a different neighbor (isn’t this illegal?!!) asking for me, as they’ve now referred my son’s loans to the same debt collection agency. Now I’ve had to send another “cease and desist” letter. These are loans both my son and daughter make payments on every month.

When President Obama spoke last October in Denver addressing the issue of student loan debt, we felt slightly hopeful, but I’ve heard nothing since that time regarding this issue. He was proposing that all student loans (federal and private) be consolidated, and there would be one payment, not to exceed any more than 10% of an individual’s disposable income. When my kids heard this, they both said, “I could do that.” They could do that; they can’t do this. I can’t do this – dealing with the constant threats and harassment. My son’s, my daughter’s and my credit is completely ruined. I am in desperate need of a newer car, but even though I am now employed, I can’t get a car loan after what Citibank has done to us.

I hear these same stories from my children’s friends and my friends’ children. Most of them are living at home again because they can’t rent an apartment; they can’t buy a car. They cannot do any of the things that young adults should be able to do, because these loan sharks are asking for 75% of their income.

My original loan was $11,000 back in 1987 and 1988!! Now, the balance with interest and penalties is over $49,000!! Wow!! What a Difference of $39,000!! I am currently living off of Social Security of $1,100 a month with my rent of almost one-half tat $500 a month.

Social Security is currently garnishing my wages for $165 leaving me with only $935 to live off with one half going to rent alone!!

So, It is not hard to see that this puts me in financial hardship by being garnished by the Department of Education. I have paid over $2,000 in Interest Alone nothing on the Principal which was only $11,000 to start. This is a Crime and a Shame the Federal Government is garnishing my Social Security!!

-Mr. Eugene R. Johnson, Senior Citizen!! and Handicapped to Boot!!l

I borrowed $5,000 in 1987 to attend a professional makeup artistry school in Covina, California. I graduated and eventually began making payments. I had a divorce and finally they garnished my wages from my job in the entertainment industry. I continued to pay them until I had the amount down under $1,000. I had some difficult years and put the payments on hold with deferments, etc. Three months ago I received the amount now owed was over $5,000 due to interest occurring. This was a loan that I took out in 1987 and was almost paid off and now has a balance over the original amount. This is 2011. I refuse to pay them all over again as I am now retired and living on social security and work with my art and whatever part time job I can find. They want me to pay back what I have already paid them. This is robbery and stealing from the American people. I have read some of the other stories and I am in awe that the banks have been allowed to create a complete business scam scheme out of the education system. I also was going to attend an online school in 2005, but backed out before I began my courses. I received a bill from a bank for $150 for the enrollment fee that was paid to a school that I never attended. I was paying them $5.00 a month for awhile and then realized I was paying for a service that I never used. This is robbery. Occupy!

Every day I wake up with dread going to a job I do not like. In fact, a career I do not like. Why? Because of student loan debt.

Original principal: $65K

Paid thus far: $25K

Currently owe: $125K

I wish I had been born in Europe.

I have a Master’s Degree and over $100,000.00 in student loans. The interest on my loans is approximately $600.00 per month. At the present my loans are in economic deferment.

I am an adjunct professor at a community college. I make $1750.00 per class, per semester; after taxes that is about $1550.00. Thus, in a sixteen week semester –five months if I teach two classes I will take home $3100.00. I do not have benefits. I have taught three classes in a semester but normally I teach two classes. As a part-time adjunct I cannot teach more than four classes. I would make more working at MacDonald’s in a four hour week. However, minimum wage employers are reticent to hire people such as myself since they assume that we will only stay until I find a better position.

Obviously I can neither afford to pay back my loans or support myself.

I live in blue collar part of the Midwest. In other words, having an advanced degree is more of a hindrance in the job market in my immediate area than it is helpful. I am fortunate that I am married and therefore I am not out on the street starving. My husband [a disabled veteran] who recently earned his Associates of Arts supports the family on his $15.75 hourly wage.

I do not want my loans forgiven. I just want a job that will allow me to contribute to my community, my country and pay back my loans before I am 80 years old. I fail to see the logic in charging me $600.00 a month interest with a myriad a different interest rates. The taxpayers are not benefitting from these charges. Although I try to remain positive and keep searching for full time employment it may be years before the taxpayers even begin to recoup the interest on my loans—never mind the principle.

The system needs to be changed NOW! Here are my suggestions for changing the system:

1. While in school, the interest rates for unsubsidized and subsidized Federal student loans should be two percent.

2. Three percent should be the ceiling once out of school.

3. There should be one constant rate for Federal Student loans.

4. These rates should come up for review every ten years and be authorized by Congress if there is to be a rate increase.

5. If a borrower is out of work for more than a twelve month period the accruing interest should freeze.

6. Once gainfully employed at a full time job [that is not minimum wage] the employer must report the status of the employee after the first ninety days. Re-payments will begin after the first ninety days.

7. For those of us with Master Degrees and above who have outstanding student loans over $50,000.00 the Government should commence an incentive program [a tax break per employee] that would encourage companies to hire job seekers with advanced degrees.

8. Government Agencies that are behind in their workload for example the State Department [paper work for immigration and non-status residents] the Veterans Administration, should have programs that allow those with Advanced Degrees who have been unemployed for more than a twelve month consecutive period or have been employed only part-time for a twelve month consecutive period who like myself cannot find full time to work that allows the borrower to be self-supportive and pay back loans part-time volunteer for positions in said agencies. Minimal loan forgiveness would be allotted per quarter. This would not only allow for better customer service from these agencies but would give those borrowers a sense of satisfaction, alleviate stress regarding loans, give back to the community and country and be a source of experience and resume filler.

What is needed is not blind subservience to the banksters and millionaire-run, corrupt colleges, what’s needed is a new higher educational system that is not designed to fleece people and put them in lifelong debt.

Clearly the current educational system has been infiltrated and taken over by the banksters and others with a Neoliberal, corporatist agenda. They have locked down 95% of the educational system, turning it into a debt slave factory. The American Empire has inflicted debt slavery on entire countries throughout the world, so there should be no surprise that they’ve done it here at home.

But it need not be this way. Educators reading this: You can take the initiative to begin new colleges that do away with nonsense like luxury student apartments, football teams, millionaire executives and all other unnecessary burdens. Bare minimum schools like we used to have are as possible today as they were in the 1970’s.

Your charge is to not just liberate the mind, but the person as well. Debt slavery is antithetical to the true purpose of academia.