Tag Results

132 posts tagged Albert lord

132 posts tagged Albert lord

In 2010 something unthinkable happened – student debt surpassed credit card debt as the largest form of debt in this country, passing $800 billion dollars. In 2012 more history will be made as the amount of unpaid student debt climbs to $1 trillion dollars, with an additional $1 million dollars added to that number every 6 minutes.

The ripple effect that this has on our economy is crushing: students and recent graduates are forced into low-wage jobs in order to immediately start making payments back to banks and lenders; instead of stimulating the economy by spending millions of dollars, students and graduates are pinching pennies to just try to keep up with the interest on their loans; and the privatization of colleges and universities are expedited as the same loan agencies use the profit off of students to lobby for lower tax rates, forcing budget cuts to higher education in an economy where recent graduates struggle to find jobs.

Imagine students not working two part-time minimum wage jobs as they struggle to get through school, allowing them more time to participate in civic engagement. Imagine recent graduates not being pushed into a job market where they are forced to intentionally keep wages stagnant, allowing them the ability to work for non-profits or local businesses.

If we do not solve the student debt crisis the students of today will suffer, but the students of tomorrow may never have the opportunity to a college education. A generation of students will pay the hefty price of their student loans; but we must not forget that we will also pay the debt of an entire country ignoring the burden placed on those working to better their lives and communities by obtaining a college degree.

…but we’re not rich, by any means.

I completed a BA and later an MA in English, and my loans totaled $42,000 when I graduated with my MA in 2008.

Undergrad loans: $28,000 original balance when consolidated (at 6.0% fixed) to a graduated repayment program in 2001. I knew when I signed the paperwork that I would eventually pay more than TWICE what I borrowed over the course of the 25 year repayment terms. I am okay with that, because I know that English doesn’t pay well, and if I managed to ever make a decent wage, I could always pay more than the minimum payment, but at least I could afford the minimum payment, which will never go above $285/mo. Current balance is still over $26,000.

Graduate loans: approximately $14,000 originally. My husband worked for the inexpensive, non-elite, middle-of-the-road, state school at which I got my MA. Instead of paying the full semester grad tuition of nearly $2300, I paid about $650, thanks to employee benefits. My husband worked full-time and I worked nearly full-time during my grad school years. I often taught three classes as an adjunct at a community college in a different state 35 miles away and took three classes at my university. I have three separate loans from grad school:

Subsidized loan (6.55%)—original balance: $6500 in 2008; current balance: $5163

Unsub loan (6.55%)—original balance: $5500 in 2008; current balance: $4942

Perkins Loan (5.0%)—original balance: $1990 in 2008; current balance: $764

My husband and I bought a house six months after I got my MA, and WE HAD NEARLY $60K COMBINED in student loans.

I am an adjunct English instructor who makes maybe $30K a year in a good year. Some quarters I bring home more than my husband.

How have we managed to pay down the balance of our loans?

We have only one car. My husband takes public transportation to work (his employers subsidizes 90% of his bus pass), while I drive between colleges to teach.

We bought a house that was priced $100K below the amount for which we were approved in 2008.

We don’t buy anything unless we can pay cash for it. That means we don’t have a big TV or a nice sound system. Our one car is seven (maybe eight?) years old. As much as I want the new iPhone 4S, I refuse to pay $200 for the upgrade because I don’t have the money, so I still have a broke-down, slow-ass iPhone 3 (it’s not even the 3G). As much as my husband wants the new xBox Kinect, we don’t have the money, so he makes do with the xBox we bought with our wedding money when we were married SIX YEARS AGO. We don’t travel—we moved across the country from our friends and family five years ago, and we haven’t been back. We’ve missed weddings and graduations and births and deaths and all kinds of big things, but we have a budget and we stick to it, as much as it sucks.

Most of our furniture is hand-me-down, including our two chests of drawers, dining room table, beds, and bed frames. We bought a couch and love seat when we first moved into our house, and it was $125 at a yard sale. It’s stained and has marker spots on it and the cushions are tearing at the seams, but we got $75 covers for them, and they look good as new.

The money we do have goes to pay off debt—student loans, the occasional credit card debt (since emergencies do happen and we’re still paying for them). And we save for the summers when I’m not teaching.

The point is, it’s not easy, and we’ve kept on top of it and avoided forebearances and deferments before things got out of control. I know it’s getting harder and harder to outright pay for an education, but it can be done with careful planning and research, and lots of hard work. I am looking at going back to get a PhD or a second Master’s, but if I do it, it will be at my own pace and I will pay cash as I go.

Does YOUR representative support Hansen Clarke’s Student Loan Forgiveness Act of 2012 (H.R. 4170)???

http://www.change.org/petitions/rep-mike-mcintyre-support-the-student-loan-forgiveness-act-of-2012-hr-4170

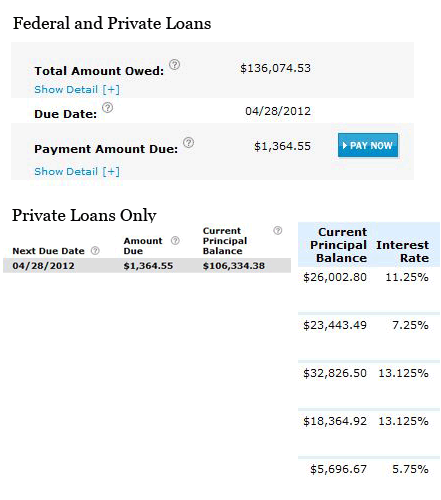

I took out $60,000 in private student loans initially. This included living costs, lab costs and materials costs. Since I graduated in 2005, this has ballooned to $107,000. I pay $1350 a month simply to one set of private student loans from Sallie Mae.

They absolutely refuse to work with me. If I wasn’t lucky enough to find a “decent” paying job, I would still be behind on these bills. It took me years to even be caught up at all — in the process hurting my credit and demolishing my debt to income ratio. Actually owning anything seems like a pipe dream.

I took out $60,000 in private student loans initially. This included living costs, lab costs and materials costs. Since I graduated in 2005, this has ballooned to $107,000. I pay $1350 a month simply to one set of private student loans from Sallie Mae. These are not the only loans I have, yet they account for over 50% of my monthly income. The interest alone is somewhere around $1000 per month.

If I wasn’t lucky enough to find a “decent” paying job, I would still be behind on these bills. It took me years to even be caught up at all — in the process hurting my credit and demolishing my debt to income ratio. Actually owning anything seems like a pipe dream.

Sallie Mae generally refuses to work with me. I sometimes get calls saying they want to help — the only question asked if how I will be paying. If I’m late, the website displays threatening messages about how they can ruin my life and garnage my wages. The only time they EVER even have attempted to play fair was after I filed a formal complaint with the CFPB.

One thing I think is often ignored is the role the school plays in this. My school, IADT Chicago, instantly whipped out Sallie Mae paperwork the second financial aid was mentioned. They actively discouraged using other lenders, essentially making me feel like a criminal when I tried to do so.

I feel punished for going to school. To expect a 17/18 year old to fully understand a system that so directly misleads and intimidates them is insane.

Tired of people vocalizing that your publicly traded company is engaged in a predatory lending scheme? Just have them arrested!

CEO of Sallie Mae refuses to meet with students, has them arrested for protesting usury :(