Tag Results

8 posts tagged tuition hikes

8 posts tagged tuition hikes

Empty seats reserved for the administration at the DePaul Public Forum on Tuition Hikes.

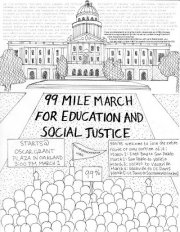

We came. We marched. We were arrested for standing up for what’s right.

Statement from students currently occupying the DePaul University Student Center:

We, the students now occupying the Student Center of DePaul University, make a call to the students and faculty of DePaul and the city of Chicago, on behalf of our Vincentian mission, to join us as we protest the forthcoming tuition hikes (both tonight and in the coming days and years).

On top of chronic education cutbacks and underfunding, students are being made to pay for the economic crisis they did not create. But as they chanted, “they say cut back, we say fight back”, and “education is a right, we will not give up the fight.”

I owe $75,000 in student loan debt. This is for 4 years of college, and a dual masters degree. Unfortunately, because of the economy there are no positions that pay above $35,000 a year — and, again, that’s with 2 Masters’ degrees, and experience! I can not pay for my student loans and housing. I work for the public as a librarian, and make the same as I did as a receptionist in 2000.

I’m harassed by a private student loan collectors saying that “We helped you when you needed it- Now pay us back!” When I try to explain that I can not afford what they are asking they will not budge at all nor negotiate.

I had one guy even say he knows plenty of librarians who make good money - “You shouldn’t have taken that low paying job!” Um- would you rather I be not working at all??? Even forgiving half would make everyone’s life easier to handle. No one can get ahead without education, but it is so expensive to go to school that it is death sentence to try to improve your life. Instead it is a life of servitude.

As a single mother who was running an office for four men who made $60k a year, and had me doing all their work at $6.50/hr I went back to school in 2000, I have a terminal degree in my field (MFA) and I am chronically underemployed, I work two jobs at two different community colleges as an exploited and underpaid adjunct professor, and though I have applied for over 100 full time teaching positions, I still don’t have one, sigh. I drive a truck that is 9 years old and has over 100k on it, gets horrifying gas mileage, but I can’t afford a better car and couldn’t get a loan for one if I could. I owe over 100,000.00 in student loans for seven years of school, all in state, state school tuition, my income included grants and graduate teaching assistant stipends however I still had to take out loans to make ends meet, and pay for daycare. I have had enough of scrimping and saving, and seeing my measly bit of retirement eaten away ever quarter by the corporate and banking shenanigans going on in our country, where major players get bailouts but I will be in debt for the rest of my life. My loans have been in deferment, except for one six month period since I graduated in 2007. I cannot possibly make payments when I am on unemployment four to five months a year because adjuncts don’t get paid for breaks, or hired for the summer semesters reliably. In five years of teaching at the college level, I have worked part of one summer.

Unfortunately, with the new, and poorly put-together, web site for Government loans (myedaccount.com), I am unable to give a good view of how much I started out with, and how much I owe now. However, the image above shows how much I have consolidated; the two $15,000 amounts are how much I borrowed, plus the interest they had accrued before I consolidated.

When I first started school and started taking out loans, I was just taking $1,000 here and $1,000 there, not thinking about all of those loans adding up, but I really had no choice. I applied for scholarships, and didn’t see any of those come through, I had gotten all the pell grants and assistance that I could, and that still was not enough.

My last two years were worse than my first two though. I was able to receive a lot more financial aid my first two years, because according to the government, it was clear that my parents didn’t make enough money to help me out, then, all of the sudden, at the beginning of my junior year, I lost 2 of my grants from the government. My dad had gotten a new job, and according to the government, that one job was enough for them to say my parents made too much money….my mom wasn’t even working at the time either because her position had been cut. So, more loans it was.

I graduated from a University that I chose because they have one of the lowest tuitions in my state, in 2010. I know that I am also fortunate that I had a job lined up before I even graduated, but this job was making $28,000 a year. I worked that job for a year to the date, and deferred my loans that entire time so that I could afford a place closer to work, because paying half of everything (I had a room mate) was cheaper than buying gas for the commute I would have had to make from my parents to work. In April of 2010, I got a call from another University for an interview, and in May, found out, I got the job.

I am far better off now as far as my finances go, but, I cringe every time I think about the fact that I am working, and had to look for a better paying job, just so that I would be able to afford my loans (that paid for my education that got me my job) when my deferments ran out; which ran out one month after I started my new job.

My grandparents send me $100 every month to go towards my loans because they want to see my education loans paid off before they die; I am so scared that won’t happen.

I know my experience isn’t the worst, but, we are all in the same boat with a debt that we have just for bettering ourselves.