Tag Results

14 posts tagged private student loans

14 posts tagged private student loans

I graduated from a local private college last May. I went back to school with elementary kids at home. I could not qualify for financial aid because my husband Makes $90,000.00 a year. Yes, that is a decent salary, but raising a family with so many fixed expenses in this economy is an obstacle. My tutition for this private college was $8,000.00 a semester. I also took out a little extra to make ends meet for gas, teaching expenses, etc. Fast forward one year I am now 43 years old with no teaching job. I have been subbing in the county for the past year, and there are 80 applicants for elementary education jobs in Grady County. If I do not receive a job soon, I will be forced to take any job because I can not keep Wells Fargo from hounding me everyday, three times a day. My payment is $679.00 per month. I also have a few more loans out, but that is my biggest and hardest to manage. The other loans range from $50.00 (which I have been paying) to 150.00 per month. So far I have paid $900.00 so far to Wells Fargo. I need to be worrying about retirement and putting my exceptionally gifted kids through college, but I am burdening my family with this debt. I am a Christain, but lately I have felt like killing myself over this!

I attended Xavier University of Louisiana as a Biology Pre-Med student with dreams of becoming a doctor and multiple scholarships to pay my tuition. But that did not happen. I left the comfort of my home state to attend school at the #1 Historically Black College for placing students into med school. The out of state tuition was so high that I needed additional funds to pay my tuition or I would have to go home. Now, I think that that would have been better.

A message to John Kerry, Scott Brown, John Olver, and Barack Obama:

Dear Sir,

I’m writing to state my frustration about the lack of support from Congress to truly help reduce student loan debt. I would like Congress to pass legislation that would reduce the interest rates on all student loans past, present, and future to 3% or lower.

As a first generation college graduate who attended public universities and earned a BS and MEd., and who has been working for the past 15 years full-time and making on-time monthly payments towards my initial total student loan debt of $70,000, I still struggle to pay down the principal balance. Currently, the principal balance is at $65,000 after several years of paying $520/mo. The interest rate is way too high and is too blame!

I’m not asking for forgiveness of my debt. I am proud to pay my own way. And as I’ve mentioned, I’ve been making payments on-time all these years but my principal balance barely goes down because the interest rate is way too high. My payment mostly goes to interest, even after all these years of paying $520/mo.

Student loan interest rates are just way too high. Rates should be no higher than 3% yet they are at 6% and even higher. My federal interest rate on my consolidated loans started at 8.125%. Thankfully, after years of on-time and automatic payments, the federal lending partner (ACS) knocked it down to 6.5%. Even still that’s very high. I still can barely knock down the principal balance. I’m on schedule to pay off my student loans by 2034 at $520/mo. I will be 62 years old. That’s outrageous. It’s bad for the middle class and our economy. There’s no way to get ahead.

If Congress could pass legislation to reduce the interest rate to 3% or lower on all student loans, it would be a win-win situation. The lender would still get a good chunk of profit while the student borrower would have a little less struggle in paying down their principal balance, and thus, have a chance to achieve the American dream of a little bit of prosperity.

Please consider sponsoring such a bill that would lower interest rates on all student loans past, present and future. Thank you.

Whoa! Sallie Mae just blinked!

Today, only a couple of hours after I delivered 77,000 petition signatures from Change.org users to Sallie Mae’s front door, the company issued a statement saying that it would start applying its $50 per loan forbearance fee to customers’ loan balances instead of simply pocketing the cash. They’re obviously hearing your voices loud and clear!

I want to recognize how big Sallie Mae’s shift is. Previously, the company had called this fee a “good faith deposit”, even though it wasn’t a deposit at all! After so many people doubted Sallie Mae could be moved even a little bit, this policy change certainly comes as welcome news.

But it still isn’t enough, and my campaign isn’t over. Their move today does nothing to help borrowers like me, who graduated into the worst job market for new grads since World War II. The unemployed, the underemployed, and others facing economic hardship have no extra money to pay this onerous penalty.

The fact is, there’s still no reason Sallie Mae should be charging its private loan customers this fee when it’s not charged to their federal loan customers. The United States federal government doesn’t think people need to leave a “good-faith deposit” when requesting a forbearance for financial hardship — why does Sallie Mae think this is necessary?

In fact, there are lots of questions Sallie Mae needs to publicly answer:

It’s obvious to me that Sallie Mae isn’t at all serious about providing relief to distressed borrowers. Thankfully, there’s more you can do to push Sallie Mae to do the right thing:

I understand that my student debt is my responsibility. It’s a debt I want to pay back. But when my mom told me that education was the key to my future, neither of us knew the game was so rigged against borrowers like me. No student considering college, or who’s in college now, should be duped into using Sallie Mae’s private financial products.

— Stef Gray

MarketWatch covers one of our own! We stand with Stef!

————————————————————————————————

Sallie Mae also said in emailed comments Monday that the fee was “a good-faith deposit that acknowledges the importance of and commitment to resuming payments in the future.”

“This is nonsense,” Gray responded, “because the forbearance fee is not applied to my debt, and is not returned to me … It simply goes directly to Sallie Mae as an arbitrary fee for doing what they do for federal loan borrowers free of charge.”

http://www.marketwatch.com/story/jobless-grads-rap-sallie-mae-over-loan-fee-2012-01-31

They say you never know who your real friends are until adversity hits. Judging by the Change.org campaign I started recently, I’ve got about 65,000 of them. That’s the number of people who’ve signed my petition calling on Sallie Mae to stop charging a fee for a deferment of student loan payments, known as a forbearance.

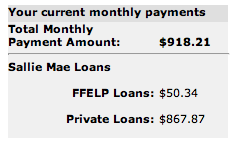

You see, I’m a recent graduate with private student loans who’s been unable to find full-time work. Sallie Mae told me that in order to place my loans in forbearance (and avoid defaulting outright), I would have to pay $50 fee per loan for each three month block — for me, that’s $150! I can barely afford to feed myself, much less $150! This fee isn’t assessed to any of the federal loans Sallie Mae services — it’s just for gouging private loan customers down on their luck.

That’s a big reason I started my campaign, and no surprise, Sallie Mae doesn’t agree. A spokeswoman told the Chronicle of Higher Education that the unemployment penalty is simply “a good-faith deposit that acknowledges the importance of and commitment to resuming payments in the future.”

Sallie Mae’s characterization of this onerous fee as a “good-faith deposit” is unbelievable! When I pay a deposit on my apartment, I get my money back at the end of the lease. If this were a “deposit” borrowers would either get their fees back at the end of the forbearance or the money would be applied to the loan’s balance. Neither of these is true.

During the forbearance period, Sallie Mae continues to add interest to the loans — in my case, more than $1,000 every three months I can’t find work. This fee is about one thing — padding Sallie Mae’s profits — and for them to pretend otherwise is galling.

Please stand with me against these predatory practices: if you haven’t already done so, take a minute to sign my petition. And please share this message with as many people as you can. Thank you so much!

-Stef

I demand to have a thoughtful and productive discourse with Key Bank because I want to pay my loans in a responsible and timely fashion.

My wife and I both had to take out private loans along with our federal loans in order to pay our full tuition. Together we pay a total of approximately 1,200.00 dollars a month combined in student loans. With the downturn of the economy and our limited combined income, we are unable to continue to pay this amount each month.

We have reached out countless times to our lenders and spent hours on the phone in order to lower monthly payments so we can continue to pay on time. Of the $1,200 we pay each month, $516 of that goes toward our private loans with Key Bank. Key Bank has been one of the most difficult and unethical lenders we have reached out to and does not even have the courtesy to even speak with us regarding our loan payments. All of our calls are outsourced to India where we must endure speaking with call center agents for hours. These agents have no insight to our situation or power to make any decisions. It becomes a vicious cycle where the customer never wins.

To make this situation even worse, the headquarters and offices of Key Bank are located ten miles from my residence, located in Cleveland, Ohio but we are still unable to reach anyone willing to help with our situation. When we call the office, our calls are automatically forwarded overseas. When I’ve asked if I could come to the offices to speak with someone, I’ve been repeatable told, “No”. When we ask for a number to call and speak with Key Bank, we are told there is no direct number for us to contact, but that an American agent will contact us. At times it can take up to three days to receive a call and when we do receive a call, we are hung up on when answering the phone, and have to start the process all over again in India.

So, to summarize, the bank that holds a portion of my student debt and is located ten minutes from my residence does not even have the courtesy or ethical standing to speak with me or my wife about lowering our monthly payments. But why should I be surprised? It’s designed that way. Key Bank puts the burden of its own unfair, unethical, and thoughtless lending practices on the shoulders of young wage earners in a another country.

Please join me in petitioning Key Bank and demanding that this company be responsible in its business practices by engaging in a direct and productive discourse with its customers.

Definition: Customer relations: are the relationships that a business has with its customers and the way in which it treats them.

I went to Stanford.

I really, really shouldn’t have.