Tag Results

6 posts tagged Stef Gray

6 posts tagged Stef Gray

One of the founders of Occupy Student Debt takes to the airwaves! Stef, we have your back!

Whoa! Sallie Mae just blinked!

Today, only a couple of hours after I delivered 77,000 petition signatures from Change.org users to Sallie Mae’s front door, the company issued a statement saying that it would start applying its $50 per loan forbearance fee to customers’ loan balances instead of simply pocketing the cash. They’re obviously hearing your voices loud and clear!

I want to recognize how big Sallie Mae’s shift is. Previously, the company had called this fee a “good faith deposit”, even though it wasn’t a deposit at all! After so many people doubted Sallie Mae could be moved even a little bit, this policy change certainly comes as welcome news.

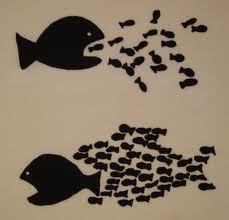

But it still isn’t enough, and my campaign isn’t over. Their move today does nothing to help borrowers like me, who graduated into the worst job market for new grads since World War II. The unemployed, the underemployed, and others facing economic hardship have no extra money to pay this onerous penalty.

The fact is, there’s still no reason Sallie Mae should be charging its private loan customers this fee when it’s not charged to their federal loan customers. The United States federal government doesn’t think people need to leave a “good-faith deposit” when requesting a forbearance for financial hardship — why does Sallie Mae think this is necessary?

In fact, there are lots of questions Sallie Mae needs to publicly answer:

It’s obvious to me that Sallie Mae isn’t at all serious about providing relief to distressed borrowers. Thankfully, there’s more you can do to push Sallie Mae to do the right thing:

I understand that my student debt is my responsibility. It’s a debt I want to pay back. But when my mom told me that education was the key to my future, neither of us knew the game was so rigged against borrowers like me. No student considering college, or who’s in college now, should be duped into using Sallie Mae’s private financial products.

— Stef Gray

Well today at the Sallie Mae office in DC was fun! Were you there with us today as one of our own delivered 76,000 petition signatures and gave a press conference? If not, don’t worry. All the news crews were so you’ll see on the news tonight :)

#HowWeRoll #WeStandWithStef #MoreUnitedThanEver

MarketWatch covers one of our own! We stand with Stef!

————————————————————————————————

Sallie Mae also said in emailed comments Monday that the fee was “a good-faith deposit that acknowledges the importance of and commitment to resuming payments in the future.”

“This is nonsense,” Gray responded, “because the forbearance fee is not applied to my debt, and is not returned to me … It simply goes directly to Sallie Mae as an arbitrary fee for doing what they do for federal loan borrowers free of charge.”

http://www.marketwatch.com/story/jobless-grads-rap-sallie-mae-over-loan-fee-2012-01-31

The campaign is gaining strength as millions of student loan borrowers could be seeing the interest rates on their loans rise significantly unless Congress extends a rate reduction passed in 2007 and set to expire this July. While the current interest rate, based on the 2007 reduction, is 3.4 percent, the rate could double to 6.8 percent, adding more fuel to the fire of protests against student loans.

As of Friday afternoon, nearly 70,000 people had signed the petition.

They say you never know who your real friends are until adversity hits. Judging by the Change.org campaign I started recently, I’ve got about 65,000 of them. That’s the number of people who’ve signed my petition calling on Sallie Mae to stop charging a fee for a deferment of student loan payments, known as a forbearance.

You see, I’m a recent graduate with private student loans who’s been unable to find full-time work. Sallie Mae told me that in order to place my loans in forbearance (and avoid defaulting outright), I would have to pay $50 fee per loan for each three month block — for me, that’s $150! I can barely afford to feed myself, much less $150! This fee isn’t assessed to any of the federal loans Sallie Mae services — it’s just for gouging private loan customers down on their luck.

That’s a big reason I started my campaign, and no surprise, Sallie Mae doesn’t agree. A spokeswoman told the Chronicle of Higher Education that the unemployment penalty is simply “a good-faith deposit that acknowledges the importance of and commitment to resuming payments in the future.”

Sallie Mae’s characterization of this onerous fee as a “good-faith deposit” is unbelievable! When I pay a deposit on my apartment, I get my money back at the end of the lease. If this were a “deposit” borrowers would either get their fees back at the end of the forbearance or the money would be applied to the loan’s balance. Neither of these is true.

During the forbearance period, Sallie Mae continues to add interest to the loans — in my case, more than $1,000 every three months I can’t find work. This fee is about one thing — padding Sallie Mae’s profits — and for them to pretend otherwise is galling.

Please stand with me against these predatory practices: if you haven’t already done so, take a minute to sign my petition. And please share this message with as many people as you can. Thank you so much!

-Stef