My name is Cassandra Coey and the lack of consumer protection currently in existence for the private student lending industry has had a terribly profound, lasting, and all encompassing effect on my life. Like so many of my peers, I was forced to take out both federal and private student loans in order to pay for college. Since I graduated from The Ohio State University in 2010 I have been unable to find gainful employment, forcing me to place my federal student loans into forbearance. Unfortunately, I am unable to do the same with my private student loans which are now held by AES. Originally my loans were through GMAC, but this company, which was a part of GMC, went bankrupt and my loans were sold to AES (where the terms of my loans were changed, and I could do nothing about it).

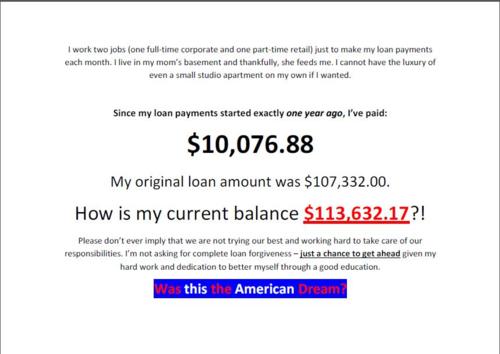

These changes added an additional $15,320.82 in interest because of a little thing called capitalized interest. My interest rate hovers around 5% of the principal & IS CAPITALIZED EVERY FISCAL QUARTER and then ADDED TO THE PRINCIPAL AMOUNT. Meaning, 5% of both of my loans (no they will NOT combine them) is added to the principal amount every 3 months of the year, starting January 1st. After another 3 months, in June, the higher amount where a previous 5% interest rate was tacked on, gets another 5% interest added onto that amount and compounded to become the new principal amount. So every 3 months my original loan becomes a much larger black hole encompassing more and more of my life.

I am stunned & appalled by this and to add insult to injury I receive countless calls every single day demanding money and threatening legal action. If I had the payment, I would pay it, but AES refuses to work with me and is now telling me that they will sue me for the entire $42,000 borrowed. I incessantly look for full-time work, and although, I do understand what I borrowed, I just want the ability to place my private student loans in forbearance as is allowed with federal student loans.

The Big Picture here is the amount I owe AES with late fees and capitalized interest has now increased to an insane amount, originating at $42,000 and is currently $60,240.60. My credit is destroyed from my inability to make payments. And today with so many employers checking credit scores, it makes it even harder to find full-time work. However, most significantly, within the next few years I would like to marry my boyfriend and start a family but we cannot, as he would inherit my abominable credit. And if we did go ahead it would be like a fish out of water, dying with no foreseeable way out.

Please take a stand with me, asking AES to allow me to place my private student loans in forbearance so I can focus on getting full-time employment, work on rebuilding my credit, and marry the one I love. All borrowers with private student loans must have the same protection awarded to those with federal loans, have the ability to place them in forbearance and in deferment, and have access to interest based repayment.