Tag Results

160 posts tagged usury

160 posts tagged usury

Cost of school: $35,000. Paid $26,000. Owe $52,000. I don’t think Sallie Mae can do math.

Between July and September, Sallie Mae spent $550,000 lobbing Congress, the Federal Deposit Insurance Commission, Federal Reserve System and Treasury Department.

WHY???

I have paid $20103.00 on the original $16,730.00 borrowed. I still owe $46,950.00. Even if I was able to pay this off today, I will have paid over 4x the amount for what I have borrowed. I don’t own a home, don’t have a family and never will, and I am harassed every single day by phone calls, texts, and emails. I have not defaulted on my loans, but I also am not paying the full amount, because I would like to continue to eat, have a place to live and be able to drive to work (in which the location changes quite often). The amount I pay only covers the late fees that Sallie Mae charges me every month, but this is no different than what happens when I pay the full amount. I had a loan consolidation done a few years ago, and the way that Sallie Mae structured the loan, there are actually two loans in a single wrapper. That allows them to take my payment and split it between the loans in such a way that it only ever covers the accrued interest and I make little or no progress on the actual principal (due to the compounding interest of 8.25%). I will never be able to retire, I will never be free of this albatross. I am an indentured slave, owned by the Sallie Mae corporation and eventually destroyed by them. I am being crushed under this systematic theft. Any value I would have gained from the education I received, has been fully extracted - siphoned off by these parasites, under the full approval of the government of the United States. I am the 99% and I am encased in economic slavery.

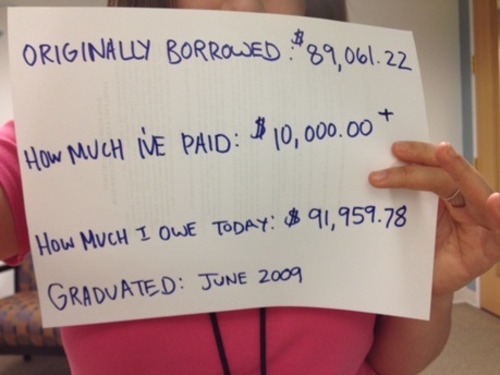

I graduated from a small private school in California. I have a BS in Anthropology and Environmental Studies. I got an excellent education. My parents could not afford to pay for college, and my school did not give out good financial aid, so I took out loans. I originally took out around 90k. I have 5 student loans, 4 of which are private.

When I first graduated college I moved to Portland, Oregon and worked a job which paid $9.00 dollars an hour because it was all that I could get (the job market up there is very bad). I had 6 months before the 4 out of 5 of loans started kicking in. I had my first mental breakdown in January of 2010 when my first payments were due, and they started around $500.00. I had no idea that it was going to be this much. I found another part time job, this one making $11.90 an hour. I worked six days a week and had to commute 35 miles for my jobs. I had to borrow money from my parents, grandparents, and roommates to get by, although it wasn’t really borrowing since I couldn’t afford to pay them back. I had to call two loan companies to change my payment plan so that I pay less now, and more later (meaning $150.00 now, and will eventually have payments of $450.00, and this is just for one loan!). By June of 2010, my 5th loan started kicking in, making my monthly totals $668.78. As my first part time job was as a teacher and ended right before summer break, I was back to one part time job. I then applied for food stamps, because all of my income was going towards student loans. I fed myself for the next few months on food stamps (thank god for that!).

Since my second part time job was technically a paid internship, I discovered that some loan companies allow you to defer during your employment. I was able to defer two private loans until the end date of my internship (August of 2010). My federal loan (Direct Loan) allowed me to defer for up to a year. The two other private loans wouldn’t help me. Once my internship was over I contacted my loan companies to let them know that I was now unemployed and was looking for work and may not be able to make full payments. They all were pretty helpful, or at least kind, except for Wells Fargo. Wells Fargo told me that even if I had $50.00 dollars left to my name, it should go to them. I made partial payments for about 3 months, thinking that as long as I paid something ($50.00 or $75.00 out of $150.00) that they would get off my case as I have called them many times to explain my situation and I could catch up once I had a job. They started harassing my co-signers (parents) and calling them every morning at 8am making threats. My parents aren’t in a good financial situation (also a lot of debt) and I woke up every morning feeling stressed and sick thinking that Wells Fargo would take action (over me being only $150.00 behind).

I moved back to California to live in my parent’s basement, since all the money that I was making was going straight to these companies and I couldn’t afford rent. I am so thankful that I have family that can help me in a time of need by providing shelter and assistance. If I didn’t have them, I don’t know what I would do. I have been pretty lucky in that I haven’t had much trouble finding work. After about 2 months (which I consider good) I found a job that pays over $19.00 an hour. However, with a monthly loan payment of $668.00 a month, I cannot afford to be independent and still can’t afford to live on my own. After taxes, 28% of my income goes to student loans alone. That is almost 1/3. I have been living in my parent’s basement for a year now, with no savings to show. I am 25 years old. I don’t know when or if I will be able to afford living on my own, especially in this economy.

I really had no idea what I was getting into, as loan payments did not become a reality until after college. I never experienced anxiety until the loan payments started, and I have been stressed ever since. At this rate, paying the minimum, I will pay off my loans in about 30 years (when I am 55). Having a large debt of 90k (not including interest) at 22 years old is scary and its even more than that today with interest applied. Although my borrowed amount was $89,061.22, since graduation (2.5 years) I have paid off over $10,000.00, and I still owe more than I borrowed with a current balance of $91,959.78. I have been busting my butt and have not even taken a dent in the money that I originally borrowed. I am not planning on ever buying a house, or a car, or having the “American Dream”. But hey, at least I am surviving and am healthy, right? I don’t think I would be where I am today without my college education, as I am in the field that I want to be, and really enjoy my job, but I definitely question my decisions. I always come back to telling myself “you can’t do anything about it now, so just deal with it”. I am trying to deal with it as best as I can.

After Highschool, I was determined to college and climb my way up into the middle class. Unfortunately, I was basically disowened by my parents when I told them I didn’t want to be Mormon or go on a mission, so I was left alone to try and pay for school. I worked 30-40 hours a week, even though that wasn’t allowed at the University. If you work more than 19h they’re required to pay for health insurance and so on, but if you find 3 jobs and different places at the Uni, they never catch on. So, like I said, I didn’t have health insurance for 12 years (ever since Clinton ended it for me in the 90s) and since minimum wage at that time was $5.25/h I managed to rake in more than $50,000 of student loans just staying alive, and mind you, I lived very poor during that time, and even stayed in-state at the University of Utah. But I worked hard and eventually got my PhD. Now, happily, I even have a job in my field as a research scientist, but only making $40,000 a year (hardly middle class salary). If I were to pay my student loans I would have to live like a PhD student for the next 10 years, and the whole reason I went to the University was to get into the middle class, and even without making payments on my student loans I haven’t achieved that. How could I ever hope to buy a house or have a family? How can it be that a hard working successful scientist hasn’t earned that right? Instead our beloved Romney makes $20,000,000/year without working and pays next to no tax on it. So, screw it, I moved to Europe. Now I could finally afford to get my wisdom teeth removed (only 10€ here, love European health care!). Now I’ve been in default for maybe two years, so the loan amount is probably well over $60,000, so I guess I can forget ever coming back. Good bye US of A!!! Hello socialist Europe!

I am still in college, I am 32 years old. The original amount of my 5 loans was original 5 loans is 42,875.75. Today (I am still in college and graduate next year), I owe $67,895.20. That is 25,019.45 in interest while I was in school, and still have not graduated yet - THAT IS INSANE!

$25019.45 in interest!

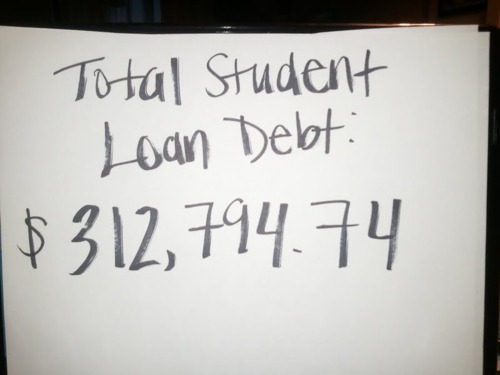

This is what happens when you try to better yourself and get a graduate degree. You just dig yourself into a deeper hole. Every single day I hope for a miracle.