Tag Results

62 posts tagged ows

62 posts tagged ows

Whoa! Sallie Mae just blinked!

Today, only a couple of hours after I delivered 77,000 petition signatures from Change.org users to Sallie Mae’s front door, the company issued a statement saying that it would start applying its $50 per loan forbearance fee to customers’ loan balances instead of simply pocketing the cash. They’re obviously hearing your voices loud and clear!

I want to recognize how big Sallie Mae’s shift is. Previously, the company had called this fee a “good faith deposit”, even though it wasn’t a deposit at all! After so many people doubted Sallie Mae could be moved even a little bit, this policy change certainly comes as welcome news.

But it still isn’t enough, and my campaign isn’t over. Their move today does nothing to help borrowers like me, who graduated into the worst job market for new grads since World War II. The unemployed, the underemployed, and others facing economic hardship have no extra money to pay this onerous penalty.

The fact is, there’s still no reason Sallie Mae should be charging its private loan customers this fee when it’s not charged to their federal loan customers. The United States federal government doesn’t think people need to leave a “good-faith deposit” when requesting a forbearance for financial hardship — why does Sallie Mae think this is necessary?

In fact, there are lots of questions Sallie Mae needs to publicly answer:

It’s obvious to me that Sallie Mae isn’t at all serious about providing relief to distressed borrowers. Thankfully, there’s more you can do to push Sallie Mae to do the right thing:

I understand that my student debt is my responsibility. It’s a debt I want to pay back. But when my mom told me that education was the key to my future, neither of us knew the game was so rigged against borrowers like me. No student considering college, or who’s in college now, should be duped into using Sallie Mae’s private financial products.

— Stef Gray

On top of chronic education cutbacks and underfunding, students are being made to pay for the economic crisis they did not create. But as they chanted, “they say cut back, we say fight back”, and “education is a right, we will not give up the fight.”

Will @SallieMae meet with Stef Gray to discuss fees tomorrow? http://chn.ge/y2ziNO Call them and ask! (302) 283-4076! #SallieMaeHem

Call @SallieMae and ask them to meet with Stef Gray tomorrow! (302) 283-4076! #SallieMaeHem

I borrowed $53,000 approximately from 1991 to 1996 to get a 4 year degree from a State College.

I moved out of the country for 2 years and was told that I could defer for that time without interest. They not only charged me interest for that time, they compounded it and the amount owed doubled.

I have never been able to keep up with the full amount of the payments and have never made more than $40,000 per year since graduation. Usually about half of that is what I make per year. I’ve tried working for small companies, started several of my own companies and do all I can to keep up with bills. My credit has always suffered and I have not been able to get business loans and need the cash flow to grow business.

I had a baby 9 months ago and am not working and we can’t afford day care so that I can work. I have started to try making some money at my touring business again and we live on my husband’s income of about $38 per year.

I recently did a Direct Consolidation of my loans and I owe $142,643.64. My payments are $1046 per month and I have deferred payments based on my income. I don’t ever see being in a position to pay this off.

The campaign is gaining strength as millions of student loan borrowers could be seeing the interest rates on their loans rise significantly unless Congress extends a rate reduction passed in 2007 and set to expire this July. While the current interest rate, based on the 2007 reduction, is 3.4 percent, the rate could double to 6.8 percent, adding more fuel to the fire of protests against student loans.

As of Friday afternoon, nearly 70,000 people had signed the petition.

A DIFFICULT POSITION

$22,000 (NO DEGREE)

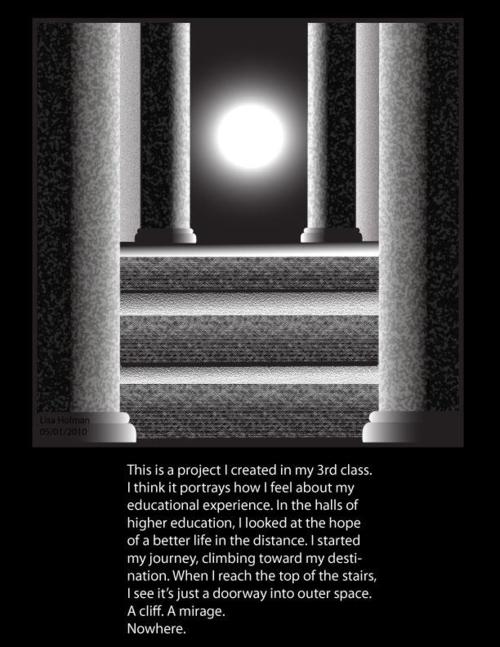

As someone who has finally taken the plunge into higher education decades after high school, I feel dumber than ever. Thanks to a for profit school (a school whose parent company is being sued right now by our government for fraud) which I found myself entangled in, I now owe $22,000 for absolutely nothing. I withdrew halfway through, in part due to the off-putting environment and the horrible teachers. I was told to sign a POP (Payment Option Plan) just shortly before I withdrew. What this is, in essence, is a promise by me that I will pay out of pocket once they have drained every bit of financial aid out of me. I was told, and I quote, that “YOU HAVE TO SIGN IT.” Stupidly, I did sign it. After going to this school of hard knocks, I now know that the credits don’t transfer, and even if I graduate, it probably won’t turn into a job anyway. This is due to the fact that the education is subpar. So, the only choice I seem to have is to continue to carry this debt with interest being added, and start completely over at another school, such as my community college. I am middle-aged, disabled, and had naively hoped this education would provide a chance at getting out of poverty. From the moment I made that fateful call to this school expressing interest, I was hounded and coerced into signing papers before having a chance to actually read them or think about this major, life-altering decision. These people prey on the hopes and dreams of good, otherwise smart, individuals. I wish I had never made that call. I am now more scared than I was before that call.

I hope and pray that someone can help people like me with relief from some of this debt. At the very least, freeze the interest that is building up. Make student loans eligible for bankruptcy. Allow students to open class action lawsuits against these for profit colleges.

PROVIDE SOME KIND OF RECOURSE FOR STUDENTS.

WE HAVE NO TOOLS TO EVEN BEGIN TO DIG OUR WAY OUT.

Just for the record, and for whatever it’s worth, I have earned a 3.9 GPA so far.

Thank you for taking the time to read this petition.

Lisa H.

12/18/11

UPDATE:

With my grace period about to run out, I had a hard choice to make. I have to get back into school before my loans go into repayment. I have weighed my options, which are, continue on in this school that I was attending, or start over at the community college. I am disabled, so going to school the traditional way (not online) is not doable for me. The only option I have is to go back to the school I withdrew from. I am very worried about the outcome of all of this. I am only halfway through and already owe $22,000 plus interest. I have no other choice. I feel like a hamster on a wheel. I’M STUCK.

“A year after I entered college, there was a time when four of us children were attending college simultaneously. My mother was recently diagnosed with colon cancer at the time but was still working and we were not eligible for financial aid. After she passed away, about three years into college, I finally became eligible for financial aid. Aside from access to loan amounts, credit card lenders were extremely aggressive towards approving credit lines for young college students. I found myself in severe debt within a year. I used financial aid to help pay for tuition and books but still found myself having to work at least two jobs at a time in order to make ends meet and afford to live in San Francisco near school, even with a roommate. Now, over 20 years later, and summers of college at the local community college, I am still about $20,000 in student loan debt, constantly having to re-enter forbearance status, year after year. The monthly bills are impossible to keep up with, after paying monthly living expenses, living in the bay area, unable to find a job where I can earn enough to offset these monthly expenses. I constantly feel like I’m playing “catch-up” and will never find a time when I can afford to get out of forbearance status. I am drowning in debt and just need some help to get some “footing.” I’ve worked extremely hard. I stayed in school. But it has not paid off.”

I have just completed my master’s degree in Counseling and Psychotherapy. I graduated with a GPA of 3.4, which is something that I am extremely proud of. Previously I graduated from college with a Bachelor’s degree in Behavioral Studies. That degree I had to fight for due to a learning disability that I had just been diagnosed with the summer prior to my graduating. My disability prevented me from passing a class that I needed in order to get a Bachelor’s in Psychology and I then had to fight my university for my modified major/degree in order to graduate. I had to jump through a lot of hoops—writing petitions to graduate, taking tests in order to “test out,” and interview with the head of the psychology department as well as appealing things with the registrar. My bachelor’s degree was hard fought for.

With my college degree and my master’s degree under my belt, and looking at all of the loans that I have taken out in order for me to have gone to school I know that I have totaled loans in excess of 100K—and this scares me to death. I am currently unemployed because for the last year I have been busy writing my thesis and didn’t have time to look for a job and with the economy still the way that it is and job prospects looking kind of bleak, I thank God that I can still live with my parents. However, I just got my loan bills in the mail yesterday and I don’t know how I’m going to pay them for this next coming month.

I have pursued the American Dream by going for my dream through education and getting my master’s degree and now I’m stuck with all of this debt with seemingly no end ever in site and I don’t know what to do much like a lot of other people in my position. We need help. And we need to stop being punished for doing what we are supposed to do—making something of ourselves.

I started undergrad in 2004, finished in 4 years with my bachelors. I had scholarships and Florida bright futures so fortunately I didn’t have to take out too significant of a loan…at least my first 2 years of school. But once I started in my major (Athletic Training) I wasn’t able to work enough to support myself so had to take out loans to help with cost of living. Didn’t spend outside of my means, used the loans wisely. Overall I left undergrad with about $15,000 in loans.

I immediately started a graduate school following graduation, I fortunately had a sports medicine graduate assistantship so my tuition was waived. However, since I worked in a Division I athletics program, I generally worked about 60 hours a week plus had full time classes. My “stipend” was only $8500 per year (for 2 years), which after books/parking passes didn’t leave much left for things like paying rent or buying food….definitely didn’t leave anything to pay towards under loans. Needless to say they stayed in deferment for the 2 years of grad school. I was living in “poverty” level….however, since I was considered a “work-study” student, I didn’t qualify for any type of assistance. I took out two small loans totaling $3000 to help with basic costs of living, since I worked too many hours and was unable to pick up part-time jobs.

Now, a year and half following graduation from grad school I’m working an average job. I make $34,000 with a masters degree, which is a somewhat normal salary for an athletic trainer. My husband finished school this past March and is unemployed, avidly seeking work in the Civil engineering field. I borrowed an initial $18,000…..only a year and a half out of school, with accrued interest I owe approximately $26,000. My husband borrowed an initial $40,000…..6 months out of school and he owes $56,000. We currently cannot afford to pay “interest only payments” on our loans…..needless to say, Sallie Mae is not very eager to assist in any way. I’ve had several phone calls end by them telling me that “if I’m not calling to make a payment then there is no point in continuing further conversations”. The term loan shark comes to mind……I’m waiting for any day now a guy with slicked-back hair in a leather jacket to come to our door with a baseball bat and demand we pay in full or else……any day now….

WE NEED REFORM!!!!!!!