November 2011

265 posts

3 tags

worth it, but punishing!

3 tags

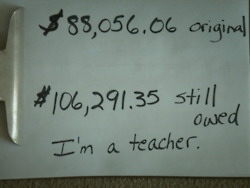

Broke teacher

I owe 54,000 in student loans, which was my current salary last year. I am a single mother with a daughter attempting to go to college herself. We BOTH live with my mother because on that salary I cannot afford rent, food, electricity, car payment insurances etc etc. and student loans. At 45 I have come to the conclusion that I will never own a home if I continue to live in the United States...

2 tags

This Amount will double by the time I can pay it...

$21,000

#occupystudentdebt

2 tags

3 tags

Rev.

As a father of 4 with a wife disabled by MS, while I pursued my M.Div. at age 40, we were granted about $25K in loans. I/we now owe $65K. I am 66 yrs. old, retired, receiving Soc. Sec. and my wife of 46 yrs. is dead. I cannot possibly repay the consolidated loan amount in my life time. I have $10-15 left in my checking account at the end of each month and usually 1/8 tank of gas and nearly no...

2 tags

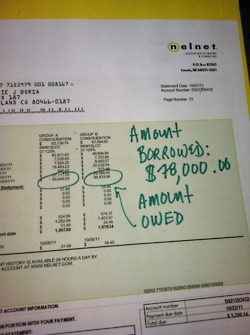

From $35,000 to 79,000!!!!!!!!

I started out with a $35,000 school loan debt that has now climbed to $79,000. I defaulted on payments because I couldn’t afford the payment. I’m a school teacher just barely making over $40,000 a year. Nelnet turned my loan over to a collection agency. They put me into a rehab program with manageable payments. After 6 months Nelnet bought back my school loans from the collection...

3 tags

2 tags

No end in sight

I borrowed $43,600 and owe $48,600.

Between my wife and myself, we pay nearly $1500/month to “service” our student loans. That is more than our rent. This fixed cost is keeping us from saving, buying a home, or otherwise putting that money back into the economy.

#occupystudentdebt

3 tags

3 tags

How can I save for my children to go to college?

2 tags

HELP!

I graduated college in 2005, originally borrowed a total of $54,232.62, even only paying a lower interest rate and a fluctuating repayment plan over the course of almost 7 years of paying back my loan I still owe at this time an amount of $54,158.13 as you can see not much has come off at all. Hopefully this will come to some sort of a change to help those who struggle to make ends meet but still...

In 1971 I graduated from college with $1600 in student loans. The interest rate on the loan was 3%. 50% of my loan was forgiven over 5 years because I taught. My first teacher’s contract was for $6,900. The economy was way different but my main point is my first contract was greater than my loan debt.. Now new teachers are accepting employment with much smaller salaries than their student...

2 tags

3 tags

2 tags

I borrowed $89,100 to cover my tuition and living expenses during three years of law school. I just graduated in May 2011 and have not found a permanent job yet, so I have been forced to ask for a forebearance on my loan repayments.

Even if I can pay my loans off in 10 years, I will still pay a total of at least $144,000 (min. $1200/month) because of compounding interest.

I received...

3 tags

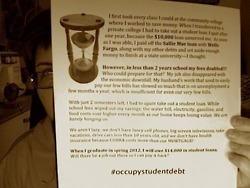

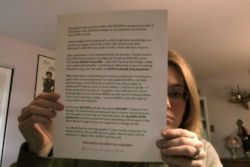

Told I was doing it right

Sorry, no photo, no camera.

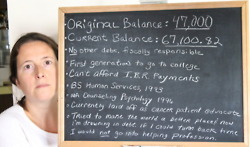

Original Balance: $72,000 (about)

Currently owe: $99,500 (about)

Be paying ontime now for 15 months. $1000 a month. I’ve been making it work, I am lucky (so far). I do not want my loans to be forgiven or for the university to not be paid. I signed the line.

What I do want:

1. Honest financial counseling, especially for first time/first person in college from...

2 tags

One big problem

With the income-based repayment plan, the income it is based on is pre-tax. I qualify for IBR as a teacher but after paying almost $12,000 in federal taxes alone, I drop from a $70,000 salary to around $58,000. And this doesn’t count the almost $4000 in state tax. Still, the IBR plan calls for a 10% of my pre-tax money for 10 years and I can’t afford a $700 payment. The IBR...

3 tags

October 2011

98 posts

3 tags

3 tags

Jail For-profit scamsters

I got out of the army in 2002.

I wanted to be creative like my mom but have a practical use for it and a career. I was lied to/fooled/tricked into attending 2 for-profit colleges in 2003 and 2006. The Gi Bill went toward cost of living.

Instead of a free education I got $83,000+ in student loan debt. Most of it is private loans the schools told me were FEDERAL. The first school gave me the...

100 Tumblr Followers in 2 days! ...And who knows...

Thank you all for supporting this project! Reading through all of the submissions is heartbreaking, and I appreciate the fact that you’re standing by us.

Together, we’re busting the myths that student debtors in over their heads are lazy/entitled/whining/etc.

We’re educating the public about how predatory student lenders have lobbied Congress to make it incredibly difficult for...

3 tags

I have an Associate’s and a Bachelor’s degree. I do not have any student loan debt. I went to a state school. I am LUCKY that my parents were able to help me out either by paying my tuition or letting me live with them. I have spent several years after college unemployed and struggling to survive with growing high-interest credit card debt. One day I would like to go to grad school....

3 tags

3 tags

cost of just one semester

Uploaded with ImageShack.us

3 tags

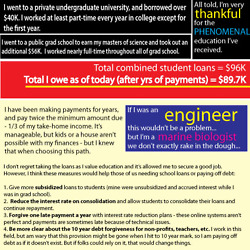

My future dream job IS still teaching!

3 tags

3 tags

3 tags

3 tags

3 tags

3 tags

The Student Loan Zone

#occupystudentdebt

3 tags

Wasted time

I started college under the advertised lie that promised a great job with a degree. My AA and BA will be virtually useless in this market.

3 tags

3 tags

Borrowed $16 K, now private company wants $160 K

After paying for and working for and throughout my education from BA through MA, I finally had to borrow $16,000 for my PhD. I have paid at least $1000, and now owe $160,000. A private company bought and consolidated everything & have never accepted my offer of $100/month payments. I have defaulted in despair. All my tax returns for years have gone straight to the private company. It took me...

3 tags

My Student Loan Debt Crushed My Family (no photo,...

I attended graduate school at The University of Virginia from 1985-87 and took out $10,000 then I continued graduate work at the University of Houston with a fellowship for five years and took another 10,000 I started paying back the debt in 1991 and I am still over 23,000 in debt. I have worked continually as an “adjunct” at many Universities without any health insurance. After the...

2 tags

3 tags

3 tags

Borrowed $56,000 Owe $84,000

I borrowed $56,000 for my education and my parents borrowed $52,000. They still owe the full $52K because they are only paying interest right now and I cant find a job that will allow me to live and pay for my student loans so the fees and interest keep piling up. I now over $84,000. I used to joke that I was going to have children just so when I died they could pay off my student loans. I...

3 tags

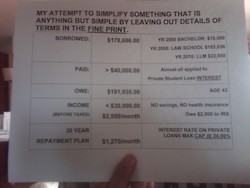

Total amount of grants / fellowships / scholarship (undergrad + law school) = 250,000

Total amount of student loans = 180,000

The tuition of “prestigious” for profit schools are so high that poor students suffer despite being the smartest person in class. The education system is rigged against the lower and middle class.

2 tags

3 tags

2 tags

2 tags

Forgive the Debt

I was employed in the business world as a manager, and making very low wages considering the work I was doing, My associates degree was not enough to get a promotion I was told I needed to upgrade in order to be promoted. I spent the time and money to get my Bachelors degree in management. But due to the financial crisis many companies have down sized and are hiring managers who are unemployed...

3 tags

Karla's Student loan

This student loan locks me out of most jobs I went to school for, because the salary range for those jobs gives me a salary that is just big enough to disqualify me for deferrment, but not big enough to be able to make the payment I’m required to make. My only other option is to make a very small salary outside my field so I qualify for deferment. The interest continues to accumulate.

2 tags

I am old, and still paying

I am 54 years old and paying $500 on a 40 year loan….. How’s that going to work out.

3 tags

FORGIVE STUDENT LOANS

We were told to work hard and stay in school, and that it would pay off. We are not lazy. We are not entitled. We are drowning in debt with few means of escape. We would give anything to pay our debt, but we are un(der)employed due to the jobs crisis and lack of consumer protections and refinancing rights make things extremely difficult. The student loan bubble may not burst with a bang, but it...

3 tags

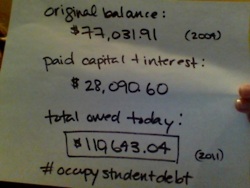

#occupystudentdebt

I can’t remember what I originally borrowed. All I know is that I still owe this much: